Dear reader,

After what looks like a good result from SSP group. Lets take a look at their most recent full year results. The stock is currently trading at £1.77, up +9.62% yesturday, but down -16.57% over the past year and -67.57% over the past five years. Is their value to be found in SSP group?

Sector: Hotels, Restaurants, and Leisure

Dividend Yield: 1.42%

P/E Ratio: 29

P/B Ratio: 6.7

Debt/Equity Ratio: 5.95

PEG Ratio: 2.79

Overview

SSP Group is a multinational operator of over 550 brands, including Camden Food Co., Burger King, and Juniper & Co., spread across 35 countries. These brands are strategically located in high-footfall travel hubs such as airports, railway stations, and leisure venues, making the company a vital player in the travel and hospitality ecosystem.

Travel-based consumer spending is SSP Group’s lifeblood. This positioning not only provides stability through long-term concession contracts but also creates dependence on global travel demand. When passenger volumes soar, SSP thrives; when they decline, as during the COVID-19 pandemic, SSP struggles.

Business Model

SSP’s model revolves around concession agreements with major travel hubs, typically signed for multiple years. These agreements give it near-exclusive rights to operate food and beverage outlets in these locations. The model ensures predictable cash flows while allowing SSP to charge premium prices due to the captive audience of travelers. However, it also ties the company's fortunes to travel volumes, exposing it to external risks such as economic slowdowns, pandemics, or geopolitical unrest.

SSP focuses on three pillars:

Operational Excellence: Reducing costs and improving service delivery in established markets.

Geographic Expansion: Entering emerging markets with high-growth potential.

Brand Diversification: Maintaining a balanced portfolio of proprietary and franchise brands to appeal to diverse customer segments.

As always, it's important to dive into the numbers, and that's what we are about to do:

Financial Analysis:

Income Statement

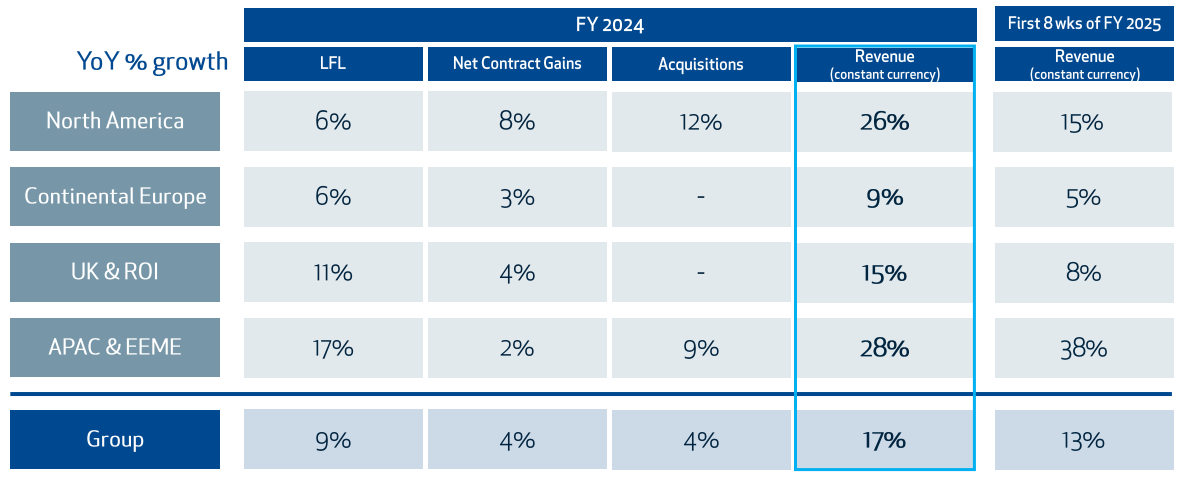

SSP delivered robust top-line growth in FY24, with revenue rising 17% to £3 billion. This growth was driven by a 9% increase in like-for-like sales and ongoing recovery in global travel demand. However, inflationary pressures and rising labor costs have constrained margins, demonstrating the challenges of operating in a high-cost environment.

Operating profit improved by 15% to £247 million, reflecting efficient cost management despite these challenges. While this growth is commendable, the company’s heavy reliance on passenger volumes underscores its vulnerability to external shocks.

Balance Sheet Analysis

SSP Group’s balance sheet at the close of FY24 showcases a balancing act between growth-driven investments and financial discipline. Total assets saw a modest increase, fueled by capital investments of £280 million and acquisitions totaling £150 million, reflecting a commitment to growth in high-potential regions. However, net debt rose to £1 billion, up from £850 million in FY23, as the company financed these initiatives partly through borrowings. While the increase in debt could be a concern, SSP successfully reduced its leverage ratio to 1.8x Net Debt/EBITDA, returning to its medium-term target range of 1.5-2.0x. The company’s focus on improving cash flows and scaling back capital expenditures in the coming year signals a shift toward stabilizing its financial position while maximizing returns from its recent investments. Nevertheless, closely monitoring debt levels and maintaining liquidity will be critical to sustaining a stable financial position.

Cash Flow Statement Analysis

SSP Group’s FY24 cash flow performance highlights its emphasis on reinvestment to drive growth. Operating cash flow reached £320 million, which funded £280 million in capital expenditures and £150 million in acquisitions. While these activities resulted in free cash flow declining to £87 million, they underscore the company’s focus on strategic expansion. The improved leverage ratio of 1.8x Net Debt/EBITDA aligns with SSP’s medium-term goals, though the substantial outflows reflect the challenge of balancing growth with financial sustainability. Moving forward, the planned reduction in capital expenditures in FY25 could help bolster free cash flow. However, the success of this shift will depend on effectively integrating recent investments and maintaining consistent revenue growth to ensure financial resilience.

Relative Valuation

SSP Group has a Price-to-Earnings (P/E) ratio of 29, which suggests it is trading at a premium compared to many of its industry peers. This higher valuation may reflect investor expectations regarding the company’s growth potential, especially as it recovers from the pandemic and undertakes strategic expansions. The company also has a Price/Earnings to Growth (PEG) ratio of 0.5, an Earnings Per Share (EPS) of 6.2 pence, and a yield of 1.4%.

Historical Growth

SSP has historically outpaced the broader travel F&B market, leveraging its strong brand portfolio and operational expertise. Even during challenging periods, such as the pandemic, the company demonstrated resilience by rapidly adapting its cost structure and focusing on recovery.

Future Growth Drivers

SSP Group’s growth trajectory is closely tied to the recovery and expansion of global travel, and the company seems well-positioned to capitalize on this trend. FY24 saw notable revenue growth of 17%, driven by strong performance in regions like North America and Asia Pacific, where acquisitions and contract wins boosted sales. The company’s expansion into emerging markets, particularly in Asia, underscores its strategic focus on regions with high passenger growth potential. Furthermore, SSP is leveraging digital transformation to enhance operational efficiency and customer experience, such as through automated ordering and payment systems. However, growth in Europe has lagged, with weaker performance in countries like Germany and France. Management has outlined a five-point recovery plan for the region, emphasizing cost reductions, leadership restructuring, and exiting underperforming operations, such as the German motorway service segment. By focusing on maximizing returns from recent capital investments and integrating acquisitions, SSP is setting the stage for sustainable, compounding growth over the long term.

More flights

The UK has the largest average daily flights in europe.

1EUROCONTROL EUROPEAN AVIATION OVERVIEW

The number of UK flights has seen a notable rise in recent years, reflecting growing demand for both domestic and international travel. Airports across the country are undergoing significant expansions, such as Manchester Airport’s redevelopment and Gatwick’s plans to bring its second runway into regular use. These improvements aim to increase capacity and connectivity, paving the way for more airlines and routes. Such developments are expected to drive higher footfall, boosting tourism and business travel while stimulating local economies and solidifying the UK's status as a major global travel hub.

Market Position and Risks

Competitive Landscape

SSP operates in a fragmented but competitive market. Its scale and expertise give it an edge, but it must continuously innovate to maintain its leadership position. Local competitors in emerging markets and global players targeting high-growth regions pose significant threats.

Key Risks

Macroeconomic Sensitivity: As a travel-dependent business, SSP is highly exposed to economic downturns and travel restrictions.

Cost Pressures: Rising wages and inflation could erode margins further.

Execution Risks: The success of SSP’s recovery plan in Europe and its expansion in emerging markets is far from guaranteed.

Three competitors to SSP Group in the travel food and beverage sector are:

Autogrill – A global operator of food and beverage services in airports and highways.

Compass Group – A leading foodservice company with a significant presence in travel and leisure locations.

HMSHost – A major provider of dining and hospitality services in airports and travel hubs worldwide.

To conclude

Strengths

Leading player in a niche, high-barrier industry.

Resilient business model with steady cash generation.

Clear growth strategy focusing on emerging markets and digital transformation.

Weaknesses

Vulnerable to external shocks, including economic downturns and geopolitical risks.

Rising debt levels could strain financial flexibility.

This is a stock I’ll be keeping an eye on. The potential for growth in the UK airport sector is appealing, especially with potential planned expansions at Heathrow and Gatwick, which could drive higher passenger volumes and increase footfall significantly. Coupled with revenue growth, this is a promising sign for SSP Group. However, I will be monitoring its debt levels closely. Given that the stock is currently trading at a higher-than-average P/E ratio, I’ll be waiting for the right entry point. That said, if the company continues to demonstrate strong management and sustainable growth, I may be willing to pay a premium for a well-run business. As always, these are my personal insights, and I encourage readers to conduct their own research before making investment decisions.

Thanks for reading,

Ollz.

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.

https://www.eurocontrol.int/sites/default/files/2024-05/eurocontrol-european-aviation-overview-20240502.pdf