More and more news to digest!

I’m closely monitoring a few stocks that have recently released notable updates. In this article, I’ll explore the latest results from JD Sports (-7.00%), Ocado (+9.80%), announced on 14 January 2025, and Vistry (+14.80%), announced today, 15 January 2025.

Ocado (FTSE 250):

Retail Performance

Q4 retail revenue grew by 17.5% to £715.8m, driven by Ocado’s strategy of offering unbeatable choice, exceptional service, and strong value, supported by its technology and automated Customer Fulfilment Centres (CFCs).

Total item volumes on Ocado.com grew by 17.0% year-on-year, and average orders per week rose by 16.9% to 476k.

Active customer growth of 12.1% led to 1.1m active customers, while increased frequency in shopping further contributed to growth.

Growth was mainly driven by higher order volumes, with average basket size stable and average selling prices flat as Ocado maintained its investment in price and value.

Key Financial Drivers (Q4 2024 vs Q4 2023)

FY 2024 Performance

Full-year retail revenue grew by 13.9% to £2,685.8m.

Volumes on Ocado.com grew by 12.9%, and average orders per week increased by 12.5%.

Active customers rose by 12.1%, now at 1.1m.

Average basket value increased by 1.0% to £122.09, with basket size up 0.3% to 44.3 items.

Despite cost pressures, Ocado achieved EBITDA growth, driven by topline performance and ongoing efficiency improvements.

Strategic Progress

Ocado expanded its product offering, including almost the full M&S range, with more joint product launches than in previous years. M&S products have proven effective in attracting new customers.

The company's Perfect Orders metric (on-time and in-full delivery with no substitutions) increased by 7 percentage points, and 99% of items were delivered as promised.

Product availability and delivery slot availability improved, and Ocado added an additional half-day of shelf life to its fresh produce.

Ocado continued to invest in price, with value satisfaction increasing by 4.3 percentage points. The company also lowered prices through its "Big Price Drops" and continued its Price Promise, matching prices on 10,000 products with Tesco.

Christmas Trading

Ocado achieved a record-breaking Christmas with its highest-ever sales during the peak holiday period.

The seasonal offering included a wide range of M&S and other supplier products, with popular items like M&S party food and festive drinks seeing high demand.

CFC efficiency improved, with units per hour rising by 15%, and the Luton CFC reaching 269 units per hour.

Hannah Gibson, CEO of Ocado Retail, commented on the strong growth achieved in Q4, citing a focus on customer service, choice, and value. She highlighted the company’s progress in offering M&S products and improving price perceptions. Looking ahead, Gibson expressed confidence in Ocado's future, noting priorities for enhancing customer propositions, profitability, and technological upgrades.

My Take

I've been following Ocado for a couple of years but don't currently hold a position in the company. They're a very intriguing player in the market, and the use of their smart platform and automation is truly impressive

I appreciate how Ocado incorporates M&S products, but the use of a premium brand like M&S means the products are not exactly cheap. Another point worth mentioning is that Ocado is primarily generating its revenue in the UK, serving UK customers. While this has its advantages, it also presents challenges, especially as people in the UK feel the financial squeeze more and more. That said, the recent trading update was impressive. I'd love to see a dividend in the future. Despite the -76% decline in share price over the past five years, this could be one stock with potential for a turnaround.

Vistry (FTSE 100):

FY24 Highlights

Group adjusted profit before tax expected to be £250m (FY23: £419.1m), in line with revised guidance.

Total completions up 7% to 17,200, with adjusted revenues up 9% to £4.4bn.

220+ new partner deals signed, with over 70 deals in Q4.

Net debt position at £180m, £20m below guidance.

Strong pipeline of 16,500 mixed tenure units secured.

Outlook

Committed to asset-light, high returns Partnerships strategy.

£4.4bn forward sales position; targeting increased cash generation and reduced stock in FY25.

Confident in rebuilding underperforming regions in FY25 with new leadership in place.

Market conditions uncertain, but aiming for year-on-year progress in profit and cash generation in FY25.

Full Year Performance

7% increase in total units to 17,200, with 18% increase in Partner Funded units.

Adjusted revenue up 9% to £4.4bn, with stable average selling price at £275k.

Adjusted profit before tax expected to be £250m (FY23: £419.1m).

Partnership Opportunities & High-Quality Housing

16,500 new units secured across 61 sites for FY25.

Notable projects include a 750-home regeneration in Birmingham and a 688-home development in Coventry.

5-star HBF Customer Satisfaction rating for 5th consecutive year.

South Division Cost Issues

£105m expected impact from cost issues in the South Division, with no issues in other divisions.

Control enhancements implemented to address concerns.

Reorganisation & Capital Allocation

Operational structure consolidated from six to three divisions, led by Executive Chairs.

Focus on growth and maintaining a strong balance sheet with £55m ordinary and £75m special share buybacks.

My Take

Great results from Vistry! Despite the challenging environment for housebuilders at the moment, this offers a glimmer of hope. With strong growth, it’s no surprise investors are snapping up the stock, pushing it up by over 15% today. The UK goverment has a very strong postion on house builders and vistry could look to profilt of :

“Housebuilding formed a key pillar of the new Labour government’s pitch to the British electorate during the summer campaign, promising to build 1.5 million homes before the next general election. Investors can reasonably expect that the government will be as supportive as it can be to the sector, even if the target itself is a little far-fetched”1.

-Dan McEvoy (MoneyWeek)

That said, the share price remains low, still down 76% over the past 5 years. However, there’s still no dividend yield. With such a low valuation and a P/E ratio of just 7, this is a stock I’m keeping a close eye on.

JD Sports (FTSE 100)

General Performance

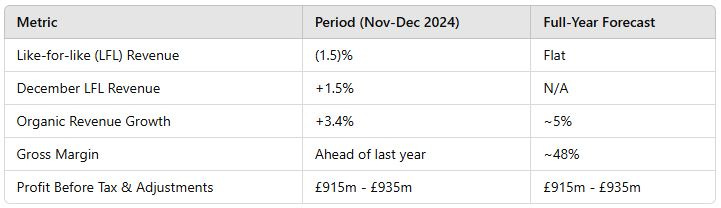

Organic revenue growth of 3.4% for the nine weeks to 4 January 2025.

December saw LFL revenue growth of 1.5%, supported by a strong Christmas performance.

Full-year organic revenue growth expected to be ~5%, with LFL revenue flat year-to-date.

Gross margins remain robust at ~48%, thanks to price and promotional discipline.

Segment & Regional Performance

Strong performance in Sporting Goods and Outdoor segments.

LFL revenue growth in Europe and Asia-Pacific partially offset weaker trading in:

The UK.

North America (Hibbett performed slightly better than the wider region).

Newly acquired Courir delivered strong trading post-acquisition.

Operational Insights

Stores outperformed online sales during the period.

The Group chose to avoid deeper promotions, maintaining discipline in a highly promotional market.

Inventory levels remain clean, supported by strong cash management practices.

Updated Guidance

Profit before tax and adjustments forecast revised to £915m - £935m, slightly below previous guidance.

Adjustments include:

Hibbett IFRS 16 costs: +£6m.

FX impact: +£2m (total £17m).

Courir contribution: +£7m.

My Take

Oh, and just to add, the CEO bought £100,000 worth of stock on 15.01.2025.

The stock currently has a P/E ratio of 13, which is lower than the industry average of 27. The dividend yield is around 1%, which is modest. JD Sports owns brands like Size?, Blacks, and Millets and also sells major brands such as Nike and Adidas, which gives it a solid position in the market. The company's growth in the US is worth noting.

Shein has affected the broader clothing retail sector, and JD Sports has not been immune. However, brands like Nike continue to have strong appeal among younger consumers, which may mitigate some of the impact from Shein, though the situation remains fluid. Moreover:

“Retailers are bracing for a £2.5 billion hike in their wage bills due to a rise in employers' national insurance contributions (NICs). JD Sports' chairman, Andrew Higginson, had cautioned last autumn that this change would spark "guaranteed inflation" and be "too much for industry to bear2"

-Amber Murray (cityam)

JD Sports has shown resilience despite facing significant market challenges, with robust trading performance even in the face of higher-than-expected headwinds. Its approach to promotions has helped maintain strong gross margins, indicating effective management. That said, flat like-for-like (LFL) revenue and a revised profit outlook suggest continued difficulties, especially in the UK and North America. However, strong performances in regions such as Europe, Asia-Pacific, and from newer acquisitions like Courir offer some positive signs for geographical diversification. JD Sports' cautious approach to trading and cash management positions it as a notable player in the global retail market, though the outlook for FY26 remains uncertain.

Thanks for reading,

Ollz

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.

https://moneyweek.com/investments/housebuilder-stocks-uk-time-to-buy

https://www.business-live.co.uk/retail-consumer/jd-sports-shares-plunge-after-30777448