From Oil to Bricks: A Rollercoaster Ride Through MONY, Wood, BP, and Crest Nicholson

LON: MONY, LON: WG, LON: BP & LON: CRST

Dear Reader,

In this update, I will provide insights on several stocks I have been closely monitoring. This analysis will cover:

Mony Group

John Wood Group

BP

Crest Nicklson

Mony Group

A stock I wrote about a couple of months ago (see the link below), and again more recently on February 17, 2025, has released some encouraging news. This positive development has contributed to a significant boost in the share price, which has risen over 10% this month. It's a company I'm particularly interested in, currently hold a small position in, and intend to keep a close eye on moving forward.

MONY Group PLC recently released their financial results for the year ended December 31, 2024, showcasing a strong performance across key metrics. The company reported record revenue of £439.2 million, representing a 2% increase from the previous year. This growth was primarily driven by a robust performance in the Insurance segment, particularly in the first half of the year, as well as expansion in their Cashback offerings.

The Group's EBITDA saw a significant improvement, rising by 7% to reach £142 million in 2024. Additionally, adjusted basic earnings per share (EPS) increased by 5% to 17.1p. These positive results have enabled MONY Group to enhance shareholder returns, with a 3% increase in dividends and the announcement of a share buyback program of up to £30 million. The company's CEO highlighted their success in helping customers save a record £2.9 billion, emphasizing that customer savings directly contribute to the Group's growth. This performance reflects MONY Group's continued execution of its strategy and demonstrates confidence in its future growth prospects.

John Wood Group

Where do we start?

Just a couple of days ago, people were thinking the company was going bust! Another Petrofac, I was reading. However, just recently, there has been some good news.

The CFO has stepped down (apparently a dodgy CV), they have released some bad results (we will talk a little about them below), share price crash (again), and some good news on a potential buyout (we don’t know what price yet)

The company expects full-year 2024 adjusted EBITDA to be between $450 million and $460 million, which is in line with market expectations. Their order book has grown significantly to $6.2 billion as of December 31, 2024, up from $5.4 billion at the end of September. However, the company faces challenges, including weaker-than-expected trading in the fourth quarter of 2024.

Wood Group now forecasts negative free cash flow of $150 million to $200 million in 2025. To address these issues, the company has announced cost-cutting measures targeting $145 million in savings between 2023 and 2026. Additionally, Wood Group plans to raise $150 million to $200 million from asset disposals in 2025 to offset the negative cash flow and maintain debt levels. While these actions aim to improve the company's financial position, Wood Group acknowledges that cash generation has yet to materialize and financial strength needs significant improvement.

This is one company i am keeping an eye on and is having a rollercoaster of a time! We dont know if they will be bought out and at what price. Here are their recent takeover bids:

Sidara (February 2025): Preliminary approach with a March 24 deadline.

Sidara (2024): Multiple attempts, final offer at 230p per share.

Apollo Global Management (May 2023): Five bids, final at 240p per share.

Check out my article on Nov 7, 2024, on John Wood Group when the share price was a lot higher but issues were there:

BP

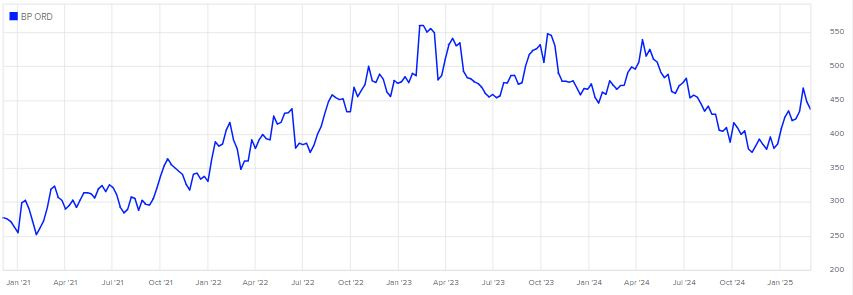

This is one share that hit the news after poor results but an activiest investor builds a significant stake. The hedge fund (Elliott Management) has acquired a nearly 5% stake in the oil giant, worth approximately £3.8 billion ($4.75 billion), making it BP's third-largest shareholder

Elliott's investment comes at a crucial time for BP, which recently reported disappointing financial results. The company's profit for 2024 fell to $8.9 billion, down from $13.8 billion in 2023. BP's share price has also underperformed compared to its competitors, rising just 1.2% over the past five years, while Shell and Chevron have seen gains of 37% and 41% respectively

The activist investor is known for pushing for significant changes in companies it invests in. In BP's case, Elliott is reportedly seeking to:

Cut spending on renewable energy projects

Push for large-scale asset divestments

Refocus on traditional oil and gas operations

BP to abandon pledge to cut oil and gas output as chief fights for group’s survival

In conclusion, BP stands at a pivotal moment, poised for potential transformation amidst significant challenges. The company's recent financial results have been underwhelming, but factors such as a strategic reset, Elliott Management's influential stake, and a possible shift back to traditional oil and gas operations suggest a path towards improvement.

Crest Nicholson

Crest Nicholson's recent financial results paint a picture of a company navigating turbulent waters. The housebuilder reported a pre-tax loss of £143.7 million for the year ended October 31, 2024, swinging from a profit of £23.1 million the previous year. This stark reversal was largely due to a £166.1 million exceptional charge, including £131.7 million related to additional fire remediation provisions.

Despite the challenges, there are glimmers of hope. The company's revenue, while down 6% to £618.2 million, was in line with guidance. Completions fell 7.3% to 1,873 units, reflecting the broader market slowdown. However, CEO Martyn Clark expressed cautious optimism about the year ahead, citing pent-up demand for high-quality homes in desirable locations.

The housing market faces headwinds from persistently high interest rates and subdued consumer confidence. In response, Crest Nicholson has slashed its dividend, with the total payout for the year down 87% to 2.2p per share.

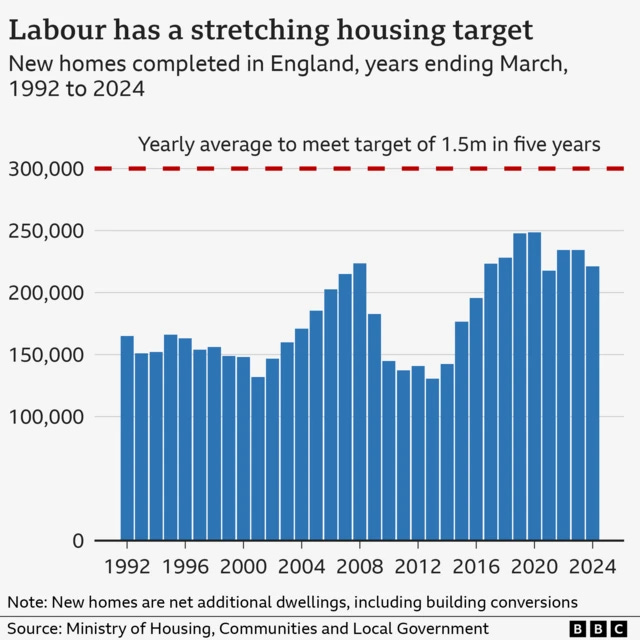

Meanwhile, the UK government is pushing ambitious plans to boost housing supply. Labour has set a target of building 1.5 million homes over the next five years, with mandatory higher housing targets for councils across the country.

The housebuilding sector is currently navigating turbulent waters, as evidenced by Crest Nicholson's recent financial results. Despite these challenges, I remain optimistic about the sector's future prospects. The government's ambitious targets to build 1.5 million homes over the next five years, coupled with reforms to the planning system, could provide a much-needed boost to housebuilders. While the sector is struggling now, I believe it has potential for improvement and growth in the coming years.

To me, the UK market appears undervalued, despite the challenges facing the economy. Timing the right entry point requires not only a keen eye for the numbers but also patience and a long-term investment perspective.

The key to investing is to keep it simple – buy good companies, don’t overpay, and do nothing. - Terry Smith

Further Reading:

https://www.sharesmagazine.co.uk/news/shares/wood-group-shares-plummet-after-weaker-than-expected-trading-in-fourth-quarter

https://ukinvestormagazine.co.uk/is-it-time-to-buy-wood-group-shares/

https://www.proactiveinvestors.co.uk/companies/news/1066267/wood-group-to-right-size-with-145mln-of-cost-cutting-whilst-strategic-review-continues-1066267.html

https://www.morningstar.co.uk/uk/news/AN_1739529108574519000/activist-elliott-management-third-biggest-investor-in-bp-%E2%80%94-reports.aspx

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.