Aston Martin PLC: How a £4bn IPO Fell to Pennies

Lessons from Aston Martin: The Cost of Overpromising and Underdelivering

Dear Reader,

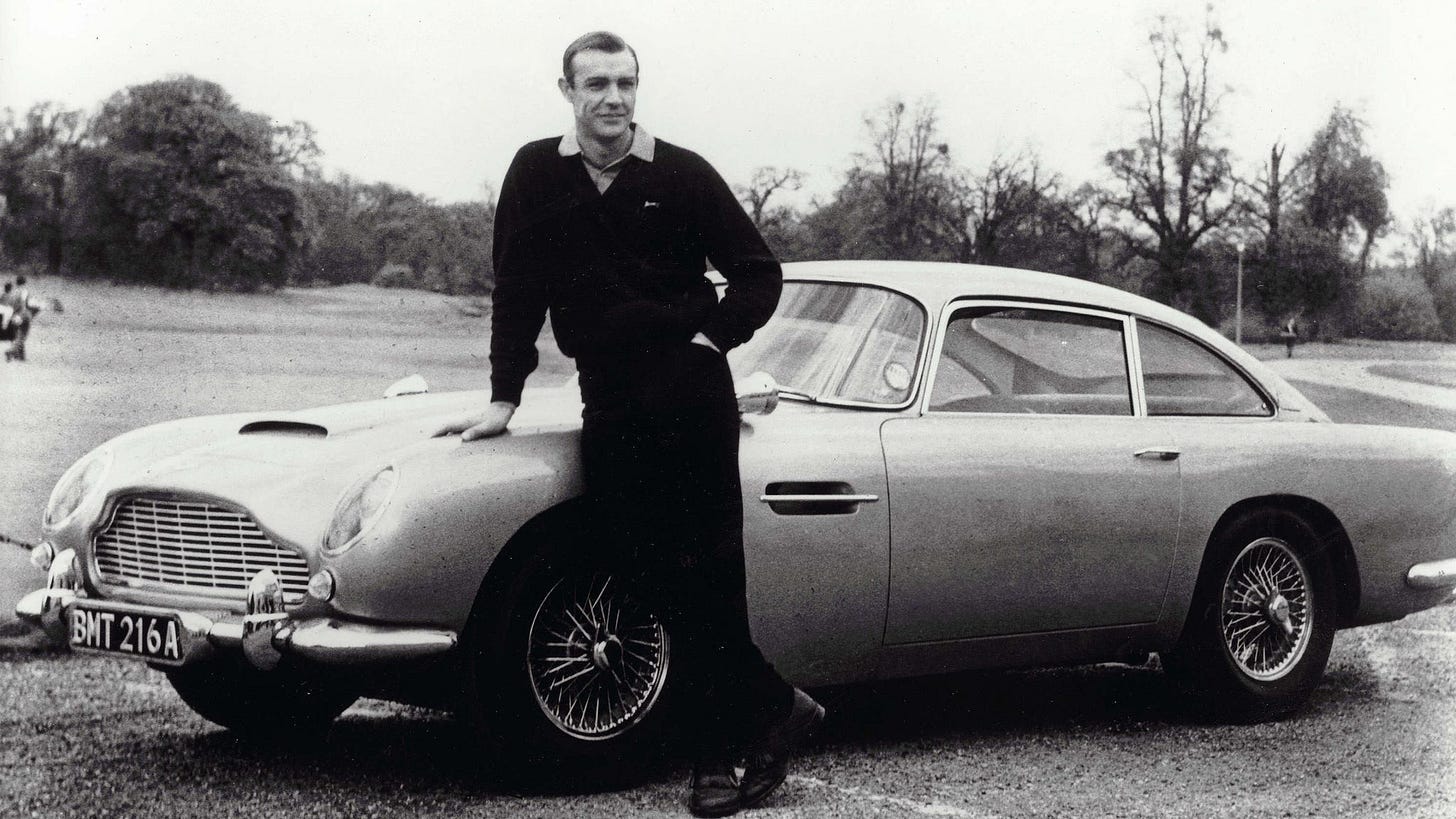

Aston Martin has always intrigued me—probably because of the James Bond films I watched growing up! Even in real life, they’re undeniably striking cars—definitely head-turners. My favourite? It has to be the DB5, made famous by 007.

But while the cars still turn heads, the same can’t be said for the share price—or the business more broadly. If you’d bought Aston Martin shares back in 2018, the experience would’ve been far from glamorous. The stock is down around 97% since then—a brutal ride for anyone who believed in the brand.

In this piece, I want to explore what’s gone wrong. What happened behind the scenes? What were the warning signs? And how did a company with so much heritage end up here?

Pic: Eon/United Artists/Kobal/Shutterstock

The share price collapse

Aston Martin IPO’d in October 2018 at £19.00 per share, valuing the company at £4.33 billion. The chart above shows the share price adjusted for a 20-for-1 reverse split in 2020, which is why the IPO appears above £37. In reality, shares never traded at that level. By June 2025, the price had collapsed to just £0.84—a drop of over 97% from the adjusted peak.

The IPO’s timing and valuation are now widely considered a misstep. Aston Martin went public just as market conditions were turning and before its turnaround plans had delivered results. This led to rapid disappointment among early investors, as reflected in the relentless decline shown in the chart.

Financial Losses and Weak Profitability

Aston Martin’s Q1 2025 results make for tough reading if you’re a shareholder hoping for signs of a turnaround. The company’s wholesale volumes were basically flat—950 cars sold, up just 1% from the same period last year. But the headline numbers tell the real story: revenue dropped 13% to £234 million, and gross profit fell by more than a third to £65 million. Gross margin, that all-important measure of profitability, slid to 27.9% from 37.2%.

What’s behind the slide? The big culprit is the sharp drop in “Specials”—the ultra-high-margin, limited-edition models that have historically padded Aston’s results. Only 14 Specials were delivered in Q1, down from 45 a year ago—a 69% plunge. That hit both the top and bottom line hard. Even though the average selling price for core models actually rose 10% (to £193,000), the total ASP fell 15% because of the Specials shortfall

^The Aston Martin 2024 "Specials" car, shown above, is the DBX707 AMR24.

Operating losses deepened, with adjusted EBIT coming in at -£64.5 million, worse than last year’s -£57.1 million. The company did manage to reduce operating expenses by 13%, but it wasn’t enough to offset the revenue and margin hit. Net debt also crept up to £1.27 billion, and the adjusted net leverage ratio ballooned to 5.1x, a worrying sign for any investor keeping an eye on balance sheet risk

Free cash outflow improved year-on-year but was still a hefty £120 million for the quarter. The company’s liquidity at quarter-end was £387 million, with a promised boost to come from a new investment and the sale of its Formula One team stake. Management is sticking to its guidance for positive adjusted EBIT for the full year and free cash flow in the second half, but that’s going to require a very strong H2, with the launch of the Valhalla and new derivatives doing a lot of heavy lifting

The signs where there

For long-term investors, the signs of trouble at Aston Martin were visible well before the share price collapse. The company’s 2018 IPO, priced at £19 a share, valued it at over £4 billion — an ambitious multiple for a business with erratic profitability, high fixed costs, and limited scale. Even then, Aston’s reliance on external capital was a concern: over half the funds raised went to selling shareholders rather than the balance sheet, and working capital demands surged as the company ramped up production of the DB11 and Vantage without a proven distribution network to match.

Post-IPO results consistently fell short of guidance. Volume targets were missed, inventory levels ballooned, and the company began discounting new models — a red flag for any premium brand. Leverage also crept higher, with net debt routinely above £800 million while free cash flow remained negative.

^Astin Martins Debt over 10 yrs

When management pivoted to the SUV market with the DBX, it was marketed as a game-changer. But despite strong reviews, the vehicle failed to meaningfully alter the company's trajectory. Frequent leadership changes — including the abrupt departure of CEO Andy Palmer in 2020 — only reinforced concerns about strategic instability.

Another red flag was the growing dealer inventory. Analysts noted Aston wholesaled 6,620 cars in 2023 but retailed just 5,918 — a surplus of over 700 units sitting unused. Across 2022–23, this added up to nearly 1,144 cars parked at dealers, straining working capital and hinting at weakening end-buyer demand. Despite record average selling prices and a climb in ASP to £231k in 2023, those elevated prices didn’t offset the imbalance — nearly 1,000 wholesale units were downgraded from guidance in 2024 due to overproduction and faltering demand in China

Aston Martin’s Vs Ferrari

Is the market itself under pressure? Are running costs starting to weigh on demand? Or is Aston Martin simply falling behind rivals like Ferrari?

Whichever it is, the share price performance tells a clear story. Over the past year, the difference couldn’t be more stark. Can you guess which line belongs to Aston Martin?

The ultra-luxury sports car market—cars priced north of $150,000—is a small but lucrative space, largely dominated by a few key players: Ferrari, Lamborghini, Bentley, Rolls-Royce, McLaren, and Porsche.

Ferrari sits at the very top of this group. Depending on how the segment is defined, it takes around 20–25% of the global high-performance luxury market. Aston Martin, by comparison, is much smaller—holding only a single-digit share—and tends to get stuck in the middle. It doesn’t have the volume or brand reliability of Porsche, nor does it command the same level of prestige or scarcity as Ferrari or Lamborghini.

Geographically, the difference is just as stark. Ferrari has built a strong presence in Asia-Pacific, especially China, where the ultra-wealthy population continues to grow. Aston Martin has struggled in the region, and still relies heavily on the UK, Europe and North America for most of its sales.

One of the biggest differences lies in how the two companies manage production. Ferrari has always kept volumes tight. Its waitlists run years, and that exclusivity keeps prices high and demand predictable. Aston Martin, on the other hand, has often produced too many cars—particularly with the DBX SUV—and that’s led to excess inventory, price discounting, and ultimately damage to the brand’s long-term value.

A Shifting Ownership Story

Aston Martin’s share register reflects a company shaped by strategic alliances and repeated equity injections. While the company had previously worked with Ford and Prodrive, it was Mercedes-Benz that became a cornerstone industrial partner in the 2010s. In 2013, Mercedes began collaborating with Aston on powertrain supply, and by 2020 it had agreed to increase its stake to up to 20%, providing access to its electric architecture and infotainment systems. In practice, Mercedes never reached the full 20% threshold and has since seen its holding diluted to just over 8%. Still, the technical relationship remains key to Aston’s electrification efforts — particularly as it looks to launch models like the Valhalla hybrid.

Today’s Shareholder Base

As of mid-2025, the shareholder register is led by a small group of heavyweight investors. Saudi Arabia’s Public Investment Fund (PIF) is now the largest shareholder with an 18.03% stake. Close behind are Chinese auto entrepreneur Shu Fu Li — known for his role in Geely — with 15.22%, and biotech billionaire Ernesto Bertarelli with 14.93%. Mercedes-Benz remains a key partner, but its holding has declined to 8.15% following multiple equity raises. Collectively, these top four shareholders control over 56% of the company.

The Turnaround Gamble

Aston Martin is once again attempting to reverse its fortunes — its third major strategic reset in under a decade — this time under the stewardship of newly appointed CEO Adrian Hallmark. The ambition is clear: deliver sustainable profitability within 12 to 18 months and reposition the brand on firmer financial footing. The roadmap is centred on three pillars: disciplined cost control, a reorientation toward low-volume, high-margin models, and a long-term pivot to electrified drivetrains.

Rather than pursuing scale, Hallmark is leaning into Aston’s core value: brand exclusivity. The strategy draws from a Ferrari-inspired playbook — extracting greater margin per vehicle through bespoke editions and limited-run performance variants. At the heart of this push is the Valhalla, a mid-engined hybrid supercar that represents both a technological milestone and a commercial test. Its successful launch is not just a product event; it’s a test for the viability of Aston Martin’s broader electrification strategy and capital discipline.

The Road Ahead

If you’d been an investor in Aston Martin since the IPO, it’s been a tough watch. The signs were there from the start—ambitious pricing, rising debt, and a business model that didn’t quite stack up. But still, there was hope. It’s Aston Martin, after all. The name carries weight. The cars are beautiful. And for a while, it felt like maybe the turnaround plans would stick.

But year after year, things unravelled. Missed targets. Cash burn. Management shake-ups. The DBX was supposed to be the game-changer. It wasn’t. Then came more capital raises, more dilution, and more disappointment. Watching it unfold from the sidelines, you started to feel like the brand was running on legacy more than anything else.

Now, they’re trying again—another reset, this time under Adrian Hallmark. The strategy sounds solid: focus on low-volume, high-margin models, cut costs, lean into electrification. The Valhalla is meant to symbolise the future. Maybe this time will be different.

But after everything, it’s hard not to be sceptical. The next year or so will be crucial. Either they execute and begin to rebuild trust, or they risk slipping further out of relevance. For anyone still watching, it’s one of those moments that could go either way—and only time will tell if this story finally turns around.

Thanks for reading,

Ollz

Further Reading and sources:

https://www.astonmartin.com/-/media/corporate-new/investors/aml---q1-2025-results-vf_v2.pdf?rev=8a8fb52e645c4e20a711e01396f5aa2e

https://www.fool.co.uk/2025/04/08/car-mageddon-the-aston-martin-share-price-has-tanked-30-in-a-month/

https://uk.marketscreener.com/quote/stock/ASTON-MARTIN-LAGONDA-GLOB-46472778/company-shareholders/

The information provided in this article is for informational purposes only and represents my personal opinions and analysis. It should not be construed as financial advice or a recommendation to buy or sell any securities. Investing in the stock market carries risks, and past performance is not necessarily indicative of future results. Readers are strongly encouraged to carry out their own research and seek advice from a qualified financial advisor before making any investment decisions. I do not accept any responsibility for any financial losses or consequences that may arise from reliance on the information presented in this article.

When the James Bond franchise kickstarts again, I bet Aston Martin hope that will positively affect their brand recognition and sales in the global south

That's also hoping that the new james bond Movies do well!