With the CEO, CFO, and Chair all recently purchasing more shares in Essentra plc, is it time for a review?

Essentra PLC (LON: ESNT) is a leading global provider of essential components and solutions, specializing in the manufacture and distribution of plastic and fiber products. The company operates through three main divisions: Components, Packaging, and Filters. Essentra serves a wide range of industries, including automotive, electronics, healthcare, and consumer goods.

Essentra plc has announced that on 18 September 2024,

Steve Good (Chair Designate & Non-Executive Director) purchased 70,000 shares at a price of 142.6p, for a total of £99,820.00.

Scott Fawcett (Chief Executive Officer) purchased 10,479 shares at a price of 142.3p, for a total of £14,911.62.

Jack Clarke (Chief Financial Officer) purchased 8,710 shares at a price of 142.64p, for a total of £12,424.80.

Let’s take a closer look at their most recent H1 2024 financial results.

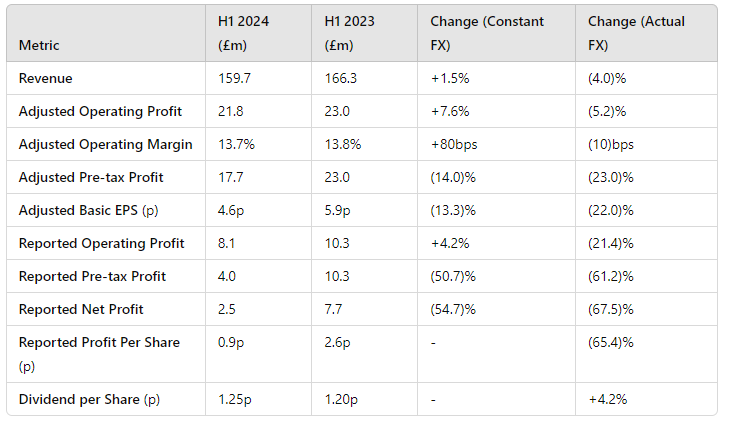

Essentra plc’s H1 2024 results present a nuanced picture, showcasing the company's ability to maintain a steady course amid challenging market conditions, while key financial indicators suggest both resilience and underlying pressures. Below is a deeper analysis of the numbers and market context behind these results.

Revenue and Profit Margins: Stability in the Face of Decline

Essentra reported revenue of £159.7m for H1 2024, reflecting a 1.5% growth on a constant currency basis but a 4.0% decline in actual terms from the previous year’s £166.3m. This decline is modest but notable, reflecting the company's exposure to currency fluctuationpus and the continued uncertainty in global markets.

The adjusted operating profit was £21.8m, compared to £23.0m in H1 2023, with a 7.6% increase on a constant currency basis. However, this fell by 5.2% in actual terms, showing that Essentra's operations are becoming more efficient, despite the pressure on revenue.

Despite these pressures, Essentra managed to expand its gross margin to 46.4% from 43.9%, indicating successful cost management and operational efficiency improvements.

Trading at near 5yr lows

Profitability Pressures: A Double-Edged Sword

While Essentra’s margins remain strong, profitability took a significant hit. Adjusted pre-tax profit fell by 23.0% to £17.7m, and adjusted earnings per share (EPS) dropped from 5.9p in H1 2023 to 4.6p, a decline of 22.0%. The difference between adjusted and reported figures is stark: reported pre-tax profit was £4.0m, down from £10.3m, representing a 61.2% decline. Similarly, reported net profit fell by 67.5% to £2.5m, and reported profit per share dropped from 2.6p to just 0.9p.

These sharp declines in profitability signal challenges Essentra faces in maintaining growth, especially with headwinds from rising financing costs and a mixed market recovery.

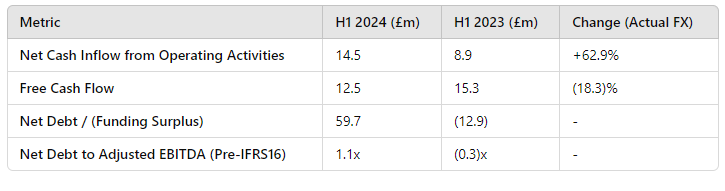

Cash Flow and Debt: A Shift in Financial Strategy

Essentra’s net cash inflow from operating activities was one of the bright spots, increasing by 62.9% to £14.5m from £8.9m. However, free cash flow was down by 18.3% to £12.5m, indicating that while the business is generating cash, its capacity to convert this into free cash is being squeezed.

A significant shift was observed in Essentra’s debt profile, with the company moving from a net funding surplus of £12.9m in H1 2023 to a net debt of £59.7m in H1 2024. This increase in leverage could raise concerns for investors, though it still reflects a manageable level of 1.1x adjusted EBITDA.

Dividend: Incremental Growth Amidst Headwinds

Despite the challenging environment, Essentra announced a progressive interim dividend of 1.25p per share, up from 1.20p, a 4.2% increase. This reflects management’s confidence in the business and its ability to continue returning value to shareholders despite the downturn in profitability.

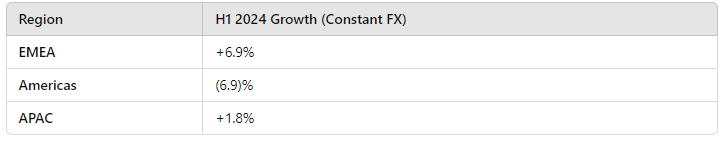

Market Performance: Mixed Recovery Across Regions

Geographically, Essentra’s performance varied:

- EMEA showed stability, with 6.9% growth on a constant currency basis.

- The Americas region saw a decline of 6.9%, though Q2 showed improvement with a more modest 4.9% decline.

- APAC reported 1.8% growth, with improvements in export markets, although domestic Chinese demand remains weak.

Outlook: Strategic Investments and Modest Growth

Essentra’s management remains cautiously optimistic about the second half of 2024, expecting modest improvements in volumes as demand recovers across end markets. The company also highlighted its ongoing focus on maintaining operational leverage and a disciplined approach to capital allocation.

Additionally, Essentra’s acquisition pipeline remains active, with management signaling potential future deals that could further bolster growth. However, the business is also maintaining a careful balance, ensuring that investments align with the goal of long-term value creation without overstretching financially.

Conclusion: Challenges Balanced by Strategic Resilience

Essentra’s H1 2024 results reveal a company navigating a difficult macroeconomic environment with a strategic focus on cost management and operational efficiency. While declining profits and increased debt are concerning, management’s ability to drive gross margin expansion and maintain dividends offers some reassurance to investors. Looking ahead, the company’s success in maintaining its balance between growth investments and financial discipline will be key to restoring investor confidence and unlocking future value.

Thanks for reading,

Ollz