What a day it has been for investors in John Wood PLC! A share that IPO’d in 2002 at £1.72.

Falls like this are uncommon and rare, with some investors shouting "fraud" and others calling it a "bargain." But what’s all the noise about?

Let’s dive into the RNS issued today:

Overview of Strategic Direction

John Wood Group continues to focus on streamlining its operations, reducing its exposure to riskier contracts, and investing in sustainable solutions. These strategies aim to create a more focused, high-quality business that prioritizes operational efficiency and growth.

Key Developments:

Independent Review by Deloitte: The board has commissioned Deloitte to conduct a review of contracts, governance, and financial reporting, driven by concerns related to previous contract write-offs and potential financial control issues.

Simplification Program: On track to deliver $60 million in annual savings by 2025, the program includes divestments such as CEC Controls (completed for $30 million) and EthosEnergy (anticipated proceeds of $95 million)(2024-Q3-Trading-update-…).

Sustainable Solutions: Wood Group’s pivot to environmentally conscious projects is evidenced by sustainable solutions now representing 46% of its project pipeline, a significant growth from 39% at the half-year mark.

Market Reaction and Share Price Analysis

The share price plunge by over 60% reflects a dramatic market reaction to recent disclosures, particularly the independent review of financial controls initiated by Deloitte. This investigation, primarily focused on financial governance, follows substantial write-offs from the company’s shift away from high-risk, large-scale EPC contracts. The company reported USD $815 million in goodwill impairments earlier in 2024, alongside $140 million in costs related to its exit from turnkey and EPC contracts.

Todays share price fall ( −75.24 (60.38%)today)

Recent Takeover Bids and Strategic Value

Earlier in the year, Sidara (Dar Al-Handasah Consultants) had expressed interest in acquiring Wood Group, with offers peaking at 230 pence per share—a valuation that placed the company around £1.58 billion. However, in August, Sidara withdrew from acquisition discussions. Additionally, Apollo Global Management, a major U.S. investment firm, had previously made several proposals but ultimately decided against pursuing a firm offer in 2023.

Financial Performance and Key Ratios

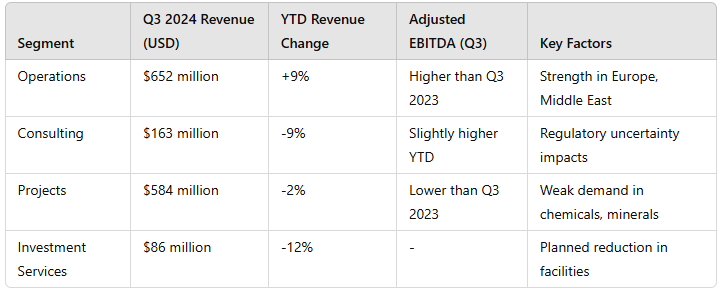

The Q3 results were mixed, with strong growth in Operations offset by weaker performances in Consulting and Projects. Below is an in-depth view of each segment’s performance.

Source: Q3 2024 Trading Update

Segment Analysis

Operations

Performance: Operations reported a robust 9% revenue increase in Q3 to $652 million, mainly from projects in Europe, the Middle East, and Australia.

Growth Outlook: This segment remains a primary driver of revenue growth, particularly as it expands in sustainable energy projects, including a significant LNG contract.

Consulting

Challenges: Consulting revenue fell 9% in Q3, primarily due to political and regulatory uncertainties affecting client activity.

Profitability: Margins in Consulting remain strong due to favorable pricing strategies, though growth prospects are tempered by external pressures.

Projects

Weakness: Projects revenue dropped 2% in Q3 due to continued challenges in chemicals, minerals, and life sciences markets.

Outlook: The Projects division’s underperformance, combined with ongoing delays in contract awards, remains a concern. The company has stated that it will continue efforts to rebalance this segment.

Investment Services

Revenue Decline: Q3 revenue dropped 12%, primarily due to a planned reduction in its facilities segment.

Strategic Realignment: This segment has a lower priority as Wood Group reallocates resources toward higher-growth areas like sustainable energy.

6. Outlook and Investor Considerations

Wood Group has reaffirmed its FY2024 guidance, expecting high single-digit adjusted EBITDA growth (excluding impacts from disposals). The outlook hinges on a strong Q4, particularly in Operations, with continued cost reductions and progress in sustainable solutions likely supporting medium-term growth.

Key Takeaways:

Positive Signals:

Operational Strength: The Operations segment remains resilient, driven by demand for sustainable and maintenance-focused projects.

Cost Efficiency: The Simplification Program and a refined project mix aim to improve margins by 2025.

Sustainability Focus: The company’s strategic pivot to sustainable solutions aligns well with ESG trends, potentially boosting long-term demand.

Risk Factors:

Financial Uncertainty: The Deloitte review and ongoing challenges in Projects could lead to further scrutiny and potentially delayed recovery.

High Leverage: Wood’s debt levels may limit flexibility in a prolonged downturn, especially as it navigates structural changes in Projects.

Conclusion

The Deloitte review is likely to be closely watched, as its findings could significantly impact John Wood Group’s financial health and shape its strategic focus moving into 2025. For value investors, this could present a "falling knife" scenario—there’s potential value in the steeply discounted price, but considerable risk as well. Investors will likely keep an eye on the stock tomorrow to see if it gets a recovery bounce after today's sharp drop.

What are your thoughts on John Wood Group and its current stock price?

Thanks for reading,

Ollz

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.

I was reading a Liontrust fund manager update recently and they mentioned that the fund had completely sold out of John Wood group due to 'accounting red flags' - looks like they made the right decision!