This Investment Trust Trades at a 25% Discount – Here's Why I'm Buying

Why HICL Infrastructure Deserves a Place in My Portfolio

Dear Reader,

This week, I want to do a deep dive into an Investment Trust (IT) I’ve been steadily buying in recent months—and for good reason. It’s a position in my portfolio, which premium subscribers get full access to.

The trust in question is HICL Infrastructure plc, a long-established FTSE 250-listed vehicle. But why am I buying now?

As a value investor, I’m constantly searching for opportunities that the broader market appears to be overlooking—assets that offer stable, long-term returns but are currently out of favour. HICL fits that bill.

The share price is currently trading near five-year lows, presenting what I believe is a compelling entry point. At the time of writing:

Share price: ~113p

Discount to NAV: -25.67%

Dividend yield: 7% (paid quarterly)

NAV per share: 153.1p

Dividend cover: 11.17

In the sections below, I’ll review the portfolio composition, examine the recent challenges that have contributed to the wider discount, and explore reasons why the market may be underestimating the long-term value of this investment

HICL Infrastructure plc

HICL Infrastructure plc (LSE: HICL) is a FTSE 250-listed investment company that targets long-term income generation from a diversified portfolio of core infrastructure assets. The company has been listed since 2006 and is managed by InfraRed Capital Partners, a specialist infrastructure investment manager with over 25 years of experience.

As of the most recent reporting period, HICL’s portfolio comprises over 100 investments across the UK, Europe, North America, and New Zealand. The majority of the portfolio (approximately 70%) is located in the UK, with the remainder spread across continental Europe (notably France, Ireland, and the Netherlands), North America, and Australasia. The company focuses on three core asset types: Public-Private Partnership (PPP) projects (46% of portfolio value), regulated assets (21%), and demand-based assets (33%).

Key investments include a stake in the HS1 rail link (UK), the A63 motorway (France), Affinity Water (UK), and a portfolio of NHS hospital projects. The weighted average asset life of the portfolio is over 30 years, and around two-thirds of revenues are inflation-linked, offering a degree of protection in a rising interest rate environment.

HICL pays quarterly dividends and has historically targeted a stable and predictable income stream for shareholders. With a long-term approach to asset management and a focus on operational performance and risk mitigation.

High Speed 1, UK. AKA as Eurostar. HICL own 21.80% of the only rail link between England and France.

HICL Portfolio and Strategy

HICL’s £3.2bn portfolio comprises over 100 core infrastructure assets across the UK (66% by value), Europe (21%), North America (7%), and Australasia (6%), offering broad diversification by geography, sector, and revenue type. The portfolio is intentionally weighted toward lower-risk, long-duration assets, with a near-even split between income-yielding (55%) and growth-oriented (45%) investments.

A key strength of HICL’s model is the predictability of its cash flows: 63% of portfolio value is derived from availability-based (contracted) revenues, 23% from regulated sources, and just 14% from demand-based income. This structure insulates returns from macroeconomic volatility, although it also limits upside participation during periods of strong economic growth.

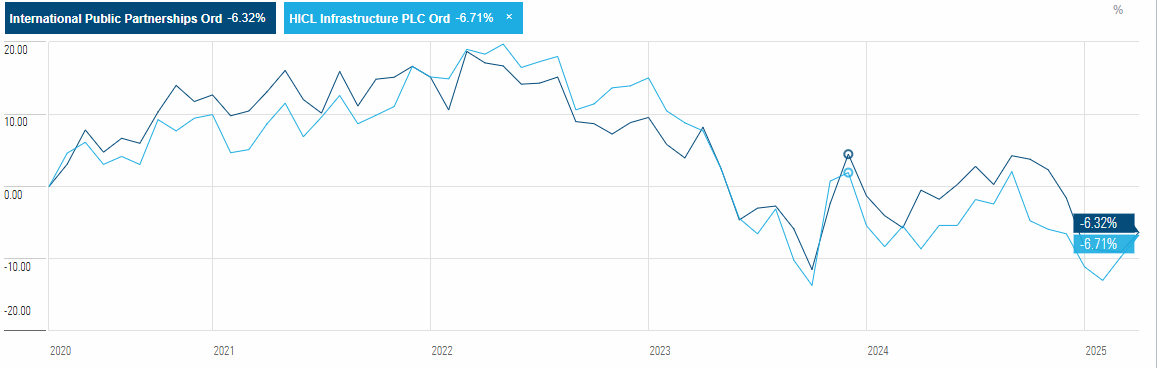

Compared with peers such as International Public Partnerships (LSE: INPP), which shares a similar core infrastructure focus, HICL has greater exposure to regulated assets like Affinity Water and Texas Nevada Transmission. These offer potential inflation-linked upside but introduce a degree of regulatory risk.

In contrast, 3i Infrastructure (LSE: 3IN) leans more heavily into core-plus and value-add assets with higher demand-based exposure—such as TCR (aviation services) and ESVAGT (offshore wind support). While 3i has historically delivered stronger NAV growth, it has done so with greater earnings volatility and less inherent inflation protection.

HICL’s Top 5 Assets – 2025 vs 2024:

Income Statement

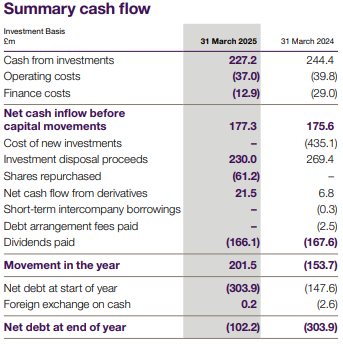

HICL generated strong operational cash flows of £177.3m in FY2025, comfortably covering its £166.1m dividend payout. Headline dividend cover was 1.07x, rising to 1.56x when including £82.7m of disposal profits—reflecting solid portfolio performance and successful capital recycling. The £244m in asset sales, completed at a premium to valuation, helped fund £61.1m of NAV-accretive share buybacks in lieu of new investments. With over £450m in capex planned through 2030, HICL’s £442m liquidity position and self-funded model offer flexibility for future growth.

Balance Sheet and NAV

HICL significantly strengthened its balance sheet in FY2025, reducing net debt from £303.9m to £102.2m—primarily funded by £244m of asset disposals. Liquidity at year-end stood at £442m, including £384m of undrawn RCF capacity, providing ample flexibility for share buybacks, capex, or future acquisitions.

The Group maintains a conservative leverage structure with no structural debt at the fund level and non-recourse debt at the asset level. However, NAV per share declined from 158.2p to 153.1p, driven largely by a 40bps increase in the portfolio discount rate to 8.4%, reflecting higher government bond yields across key markets. Despite this, the portfolio’s quality and long-term earnings base remain intact, supporting management’s confidence in its dividend guidance and capital allocation strategy.

Cash Flow

FY2025 cash flow performance remained resilient, with operating cash inflows of £177.3m comfortably funding the £166.1m dividend payout. Dividend cover was 1.07x on a pure cash basis and 1.56x including £82.7m in disposal profits—demonstrating prudent capital recycling through £244m of divestments. Notably, no new investments were made during the year, underscoring management’s disciplined approach amid valuation uncertainty. Instead, £61.1m was allocated to NAV-accretive share buybacks. With over £450m in planned growth capex through 2030 and year-end liquidity of £442m, HICL’s self-funded model remains intact, supporting both shareholder returns and future investment capacity.

Why is the Share price so low?

Rising Bond Yields: An increase in government bond yields has led to a 40 basis point rise in HICL's portfolio discount rate to 8.4%, resulting in a 3.2% decline in NAV per share to 153.1p. This adjustment reflects the market's response to higher interest rates, which typically reduce the present value of future cash flows from infrastructure assets.

Investor Sentiment: Despite solid operational performance, including a 50% increase in annual profit to £45.9 million, investor dissatisfaction has been noted. Concerns about valuation declines and the impact of macroeconomic factors have contributed to a persistent discount in HICL's share price relative to its NAV.

Market Dynamics: The broader economic context, including a contracting UK private sector and increased government borrowing, has heightened investor caution. These factors have influenced the performance of infrastructure funds like HICL, as investors reassess risk profiles amid economic uncertainty.

International Public Partnerships (INPP) has also experienced share price declines, trading at approximately 112.40p, down 7.3% from earlier levels. The factors influencing INPP's performance include:

Discount to NAV: HICL’s shares are trading at a significant discount to NAV, which has prompted the company to take action through a £150 million share buyback programme, of which £61.1 million has already been executed.

Economic Factors: Similar to HICL, INPP is affected by rising bond yields and economic uncertainties, which impact the valuation of long-term infrastructure assets and investor confidence.

HICL Fair Value calculations:

Keep reading with a 7-day free trial

Subscribe to Going Long to keep reading this post and get 7 days of free access to the full post archives.