The 5 Best-Performing Investment Trusts over 10 Years

Breaking Down the Numbers Behind 10 Years of Outperformance

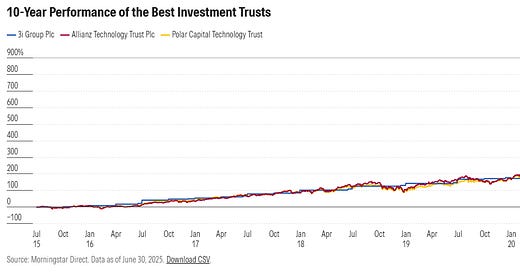

Investment trusts often fly under the radar, especially with so much focus on US stocks. Yet, UK-listed investment trusts have quietly delivered some of the strongest long-term returns available to investors.

In this post, we’ll highlight the best-performing investment trusts on the London Stock Exchange. Take 3i Group, for example, which has generated an impressive +864% total return over the past 10 years. This kind of performance shows the power of patient, active management and why these trusts deserve more attention.

The UK market offers a diverse range of trusts across sectors like private equity, infrastructure, and property. Below, we’ll explore the top 5 performers, what’s driven their success, and why UK investment trusts remain a compelling option for investors seeking growth and diversification.

3i Group

3i Group is the UK’s top listed private equity firm, with a stellar 10-year track record. Its standout investment in Dutch discount retailer Action has driven much of the return — but 3i is more than a one-hit wonder.

The £24bn trust also owns a diversified portfolio spanning infrastructure, healthcare, industrials, and services. In FY2025, 97% of its private equity holdings (by value) grew earnings, showing the power of 3i’s hands-on approach.

Its infrastructure arm added £52m in gross return this year, supported by dividends from 3i Infrastructure (3iN) and a successful exit from Valorem (21% IRR, 3.6x return).

Key Numbers

10-Year Annualised Return: +25.45%

Outperformance vs Listed PE Index: +10.31%

1-Year Share Price Gain: +36.91%

Premium to NAV (June 2025): +64.83%

With strong compounding, smart exits, and a focused long-term strategy, 3i has become one of the FTSE’s most successful compounders. The only downside? You’re paying up for it now.

Allianz Technology Trust

Allianz Technology Trust has quietly been one of the top performers over the past decade — by sticking to what it knows: big tech. Managed out of San Francisco by Voya Investment Management, the team has stayed invested in long-term compounders like Microsoft, Nvidia, and Apple, while avoiding hype and loss-making story stocks.

The result? Over 10 years, the trust’s assets have grown by an average of 22.51% a year, beating the Morningstar Global Technology Index by 1.73%. That’s no small feat in a crowded space.

In the past year, asset growth slowed to +8.96%, with the share price rising 6.93%. At the end of June, the trust was trading at a 10.21% discount to NAV — offering some value, even after a solid run.

Key Numbers

10-Year Annualised Asset Growth: +22.51%

1-Year Share Price Return: +6.93%

Discount to NAV (June 2025): -10.21%

AUM: £1.77bn

Ongoing Charges: 0.69%

ATT has done well by keeping things simple: back the winners, avoid the noise, and let compounding do the work. That approach still holds up — as long as US tech keeps delivering.

Polar Capital Technology

Polar Capital Technology has delivered strong long-term performance by taking a wider lens on global tech. Unlike Allianz Technology Trust, which is US-heavy, PCT holds a more diversified mix — with exposure to semiconductors, cloud computing, and enterprise software across the globe.

It’s managed by Ben Rogoff and the well-regarded Polar Capital tech team, who have steered the trust through multiple cycles without chasing hype. The portfolio balances megacaps like Microsoft and Alphabet with lesser-known mid-caps riding secular trends.

Over the last decade, the trust has grown its assets by an annualised 21.36%, slightly ahead of the Morningstar Global Technology Index by 0.58%. It carries a Morningstar Medalist Rating of Gold, recognising the team’s strong track record and process.

In the past year, NAV rose 11.20%, while the share price climbed 10.15%. As of 30 June, PCT was trading at a 10.19% discount to NAV.

Key Numbers

10-Year Annualised Asset Growth: +21.36%

1-Year Share Price Return: +10.15%

Discount to NAV (June 2025): -10.19%

AUM: £4.68bn

Morningstar Rating: Gold

Ongoing Charges: ~0.93%

PCT has earned its place as one of the top-performing tech-focused trusts over the long term — offering a slightly more balanced approach than some of its peers, with similar results.

HgCapital Trust

HgCapital Trust takes a slightly different approach to private equity — it focuses almost entirely on software and tech-enabled businesses, especially in Europe. This niche focus has helped it generate strong, consistent returns, with less exposure to cyclical sectors like retail or energy.

The strategy is all about buying high-quality, cash-generative businesses, then helping them grow through bolt-on acquisitions and operational improvements. It’s private equity — but with a tech bias and long-term mindset.

Over the past 10 years, HGT has delivered 17.25% annualised asset growth, beating the Morningstar PitchBook Developed Markets Listed Private Equity Index by 2.11%. That’s impressive for a trust that doesn’t chase leverage or flashy exits.

Recent performance has been more muted: NAV rose just 0.66% over the past year, though the share price gained 7.36%, suggesting investor confidence remains strong. As of 30 June, the trust was trading at a 1.72% discount to NAV.

Key Numbers

10-Year Annualised Asset Growth: +17.25%

1-Year Share Price Return: +7.36%

Discount to NAV (June 2025): -1.72%

AUM: £2.40bn

Ongoing Charges: ~1.3%

HGT isn’t as well-known as 3i, but for investors looking for private equity with a tech edge, it’s a quietly strong performer — and one that’s kept delivering through different market cycles.

Scottish Mortgage

Scottish Mortgage is one of the UK’s largest and best-known investment trusts, celebrated for its focus on global growth companies and innovation. The trust invests heavily in disruptive sectors like technology, healthcare, and consumer trends, backing companies that are shaping the future.

Managed by Baillie Gifford, Scottish Mortgage has built a reputation for spotting fast-growing giants early — including firms like Tesla, Alibaba, and Spotify.

Over the past 10 years, the trust’s NAV has grown at an annualised rate of 16.52%, outperforming the Morningstar Global Growth Target Market Exposure Index by 3.71%. Its Morningstar Medalist Rating of Silver reflects its consistent performance.

In the last year, assets increased by 19.51% while the share price rose 17.47%. At the end of June, Scottish Mortgage was trading at a 7.70% discount to NAV.

Key Numbers

10-Year Annualised NAV Growth: +16.52%

1-Year Share Price Return: +17.47%

Discount to NAV (June 2025): -7.70%

AUM: £12.92bn

Morningstar Rating: Silver

Ongoing Charges: ~0.66%

Scottish Mortgage remains a favourite for investors wanting exposure to global innovation and willing to tolerate some volatility in pursuit of long-term growth.

Are you already holding any of these top performers? Would you consider adding a UK investment trust to your portfolio?

Thanks for reading,

Ollz