Pensions Made Fun (Sort Of)

PENSION BEE GROUP PLC (LON: PBEE)

Pensions, Pensions & Pensions. How boring some people may think!

Well, in this article, I'm going to be talking about pensions and one company in particular that is making a couple of waves in the pension market.

Pension Bee Group PLC

P.E Ratio: -72.1x

Return on Assets -28.3%

Return on Equity -36.3%

Gross Profit Margin: 49%

Price/Book: 28.92

EBITDA: 4.94M

PensionBee Group Plc engages in the provision of direct-to-consumer online pensions. The company was founded by Romina Savova and Jonathan Lister Parsons in 2014 and is headquartered in London. They offer different pension plans with varying rates that reduce as your pension pot grows. People can start a new pension, consolidate old pensions, or manage private pensions. People can choose different plans, such as Tracker, Climate, or Tailored plans.

Here is a snip of their plans they offer:

PensionBee’s pricing model involves no cost for consolidating existing pensions. Once transferred, an annual fee is charged, ranging from 0.50% to 0.95%, depending on the chosen plan. For balances over £100,000, the fee is reduced by half for the portion exceeding this threshold, such as 0.25% for the Tracker Plan.

Currently, the business has £6 billion in AUM and around 265,000 customers. With operations in the UK, PensionBee is also rapidly expanding into the US and recently completed a £20 million capital raise in October 2024 to accelerate the US side of the business.

With such a competitive landscape, it’s very interesting to see how much of the market share they have already taken and how many people know about the business. With competitors like Legal & General, Scottish Widows, and Royal London, it’s a tough place to be.

With the SIPP market growing and people taking more and more control of their pensions, it’s no wonder all these businesses are coming out offering new and innovative ways to control your pension

https://www.investorschronicle.co.uk/content/e9725cd5-811f-5882-af8c-7a8dd848b5e4

Expanding to a 10 x bigger market (The US)

In 2024 the company entered the US market. This was a joint venture with State street

With already strong foundations in the US alongside a respectable partnership, the firm is hoping to achieve some big growth numbers! How big, you may ask? They have set a target to administer $20 – 25 billion in US defined contributions assets in the next 10 years. This would absolutely dwarf the UK and can make PensionBee’s revenue very, very big. You know what they say, everything is bigger in the US!

But the likes of Made.com and the poor performance of Deliveroo might make investors stay far away from UK-listed stocks. After all, the London Stock Exchange has suffered the lowest IPO volume record in 2024! Many companies have chosen to IPO in the US over the UK, and most notably, the Revolut CEO dismissed a UK IPO as “Not Rational.”

However, for the few that are a bit more optimistic, the company has been showing tremendous growth. The number of invested customers rose by 17%, climbing from 223,000 in September 2023 to 260,000. The company attributed this growth to its effective, data-driven customer acquisition strategy and the strong recognition of its household brand, which has seen prompted brand awareness reach a record high of 58%

The Numbers

PensionBee has confirmed that it has met its 2024 financial guidance as presented during its recent Capital Markets Day. The company achieved its revenue and profitability targets for the year, demonstrating progress towards its medium and long-term goals.

PensionBee is making significant strides toward profitability. Its adjusted cash loss has decreased from £7.9m to £2m in the first half of 2024, with management projecting a full-year profit. However, the company anticipates that a statutory pre-tax profit may not be achieved until 2025.

Revenue Objectives:

PensionBee set a target for Group revenue to exceed £30m for 2024.

Achieved: Revenue of £33m.

Short-to-medium-term target: To exceed £100m in Group revenue within 5 years.

Long-term ambition: To exceed £250m in Group revenue within 5-10 years.

Profitability Objectives:

PensionBee aimed for breakeven Adjusted EBITDA for the full year.

Achieved: Adjusted EBITDA breakeven at £0m.

Short-to-medium-term target: To achieve an Adjusted EBITDA margin of around 20% within 5 years.

Long-term target: To reach an Adjusted EBITDA margin of around 50% within 5-10 years.

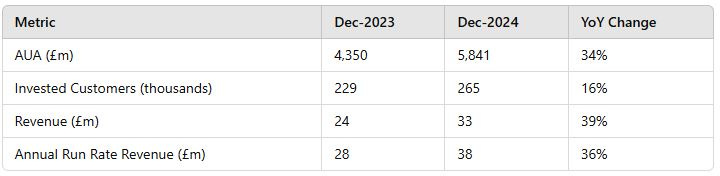

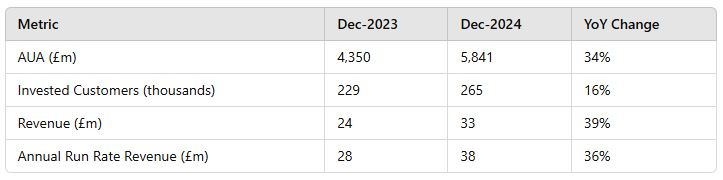

Key Metrics (YoY Dec 2023 to Dec 2024):

PensionBee’s AUA grew by 34%, reaching £5.8bn, and revenue increased by 39% to £33m.

Quarterly Performance (Dec 2023 to Dec 2024):

Adjusted EBITDA improved from a £8m loss in 2023 to £0m in 2024, with the EBITDA margin shifting from -35% to +1%.

PensionBee has experienced impressive growth, with its stock price more than doubling over the past year. However, investors are still looking for concrete proof that the company can sustain profitability as it scales.

Reaching £6bn in assets under management (AUM) marks a significant milestone, and PensionBee is steadily moving closer to achieving profitability.

The company's expansion into the US market has further raised its profile, while continued growth in the UK strengthens its position. With this momentum, PensionBee appears to be building a strong foundation for long-term success.

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.