Prudential PLC’s Q3 2024 business update reveals significant progress in key financial metrics, driven by targeted regional growth and strong operational efficiency. As one of the most prominent life insurers and asset managers across Asia and Africa, Prudential has positioned itself to benefit from demographic trends, increasing demand for financial products, and the rise of a middle-class consumer base. This article delves into Prudential's key performance indicators, regional highlights, strategic initiatives, and what these developments mean for investors.

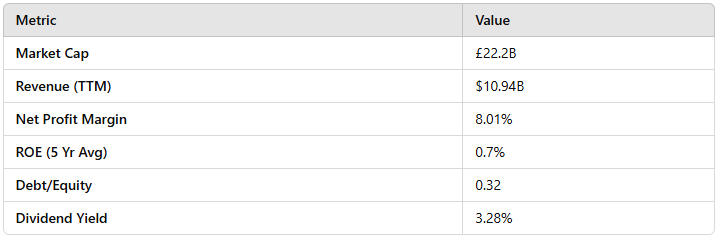

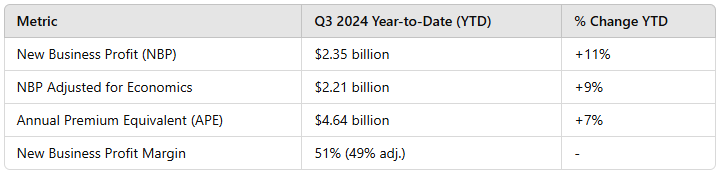

Key Financial Metrics (Nine Months Ended 30 September 2024)

Below is a summary table of Prudential's key financial metrics, highlighting strong growth across its new business profit and annual premium equivalent sales.

Key Performance Metrics

New Business Profit (NBP): A critical measure of profitability, NBP saw a significant 11% YTD rise, with a total of $2.35 billion. Prudential's strength in high-demand regions—such as Greater China and ASEAN markets—has been central to this performance. When adjusted for economic impacts, NBP still reflected strong fundamentals with a 9% increase YTD, a testament to the company’s efficient operations and solid product demand.

Annual Premium Equivalent (APE) Sales: With a 7% YTD growth in APE, Prudential has recorded $4.64 billion in total sales, indicating that consumer appetite for its products remains robust. This increase is fueled by an expanding consumer base in Prudential’s key Asian and African markets, where the demand for life insurance and financial protection products is on the rise. APE is a crucial metric for life insurers, as it captures new premium income, providing insights into future revenue potential.

New Business Profit Margin: Prudential's new business profit margin, which stands at a solid 51%, reflects disciplined cost management and effective pricing strategy. Even with economic adjustments, the margin remains strong at 49%, showcasing the company's ability to maintain profitability under variable economic conditions. This margin consistency signals that Prudential’s product mix and market strategy are well-calibrated to deliver returns across different economic scenarios.

Regional Performance Analysis

Prudential’s focus on high-growth markets has enabled it to achieve consistent sales and profit expansion. Below, we break down the performance in Prudential’s key regional segments:

Greater China: Prudential’s reputation and established distribution networks in Greater China continue to drive substantial volumes. The company’s emphasis on digitizing customer service and product access has helped it penetrate further into this high-demand market, contributing significantly to both NBP and APE sales.

ASEAN Markets: Southeast Asia remains a vital region, with key markets like Thailand, Singapore, and the Philippines contributing to Prudential’s overall growth. With a growing middle-class and increased awareness around financial protection, Prudential's ASEAN presence has expanded, supported by both direct sales channels and third-party partnerships.

Africa: While Africa is still an emerging region for Prudential, its low insurance penetration rate and young, growing population present promising long-term growth opportunities. Prudential's ongoing investments in African markets signal confidence in the future of this region and its alignment with the company’s strategic direction.

Strategic Initiatives: Driving Growth and Market Penetration

Prudential’s growth strategy relies on four primary pillars: digital transformation, expansion in underserved markets, sustainable investment, and capital return.

1. Digital Transformation

Prudential has heavily invested in digital initiatives to enhance customer access and streamline service delivery. These efforts include online platforms for policy purchases, digital claims processing, and remote financial advice. Digital transformation is particularly valuable in regions with large, distributed populations, such as parts of Southeast Asia and Africa, where face-to-face interactions may be more challenging.

2. Expansion in Underserved Markets

With many Asian and African markets showing low insurance penetration rates, Prudential has sought to fill this gap. By diversifying its product range to include affordable and accessible options, the company targets the emerging middle class and first-time insurance buyers. This approach not only supports revenue growth but also strengthens brand loyalty as customers grow in wealth and require more comprehensive financial services.

3. Commitment to Sustainable Investment

Prudential’s commitment to sustainability aligns with a growing investor preference for environmentally and socially responsible investments. The company has committed to a carbon-neutral portfolio and incorporates Environmental, Social, and Governance (ESG) criteria into its investment strategies. These initiatives not only support sustainable practices but also resonate well with investors looking for socially responsible investments.

4. Capital Return to Shareholders

Prudential’s ongoing $2 billion share buyback program underscores the company’s commitment to returning value to shareholders. This program also has the potential to improve per-share earnings by reducing the total share count, effectively increasing shareholder value over time. Coupled with dividends, this capital return strategy is a clear signal of management’s confidence in Prudential’s long-term growth trajectory.

Analyst and Investor Considerations

Prudential’s Q3 2024 results signal a well-positioned company capitalizing on high-growth markets. The significant increase in new business profit and solid APE sales growth reflect Prudential's effectiveness in meeting rising consumer demand in Asia and Africa. The company’s focus on digitalization and expansion in emerging markets further enhances its competitive edge, especially as insurance and asset management sectors witness a shift towards technology-driven models.

For investors, Prudential offers an exposure to markets with high growth potential and limited insurance penetration. However, while Prudential is poised to benefit from demographic trends, currency risks and geopolitical factors in its operational regions should be considered. Moreover, economic fluctuations can impact NBP and APE sales, though the company’s strong historical performance suggests resilience.

Conclusion

Prudential's Q3 2024 results highlight a strategic focus on sustainable, long-term growth in emerging markets. Through digital innovation, targeted expansion, and disciplined financial management, the company has demonstrated strong financial health and adaptability. As Prudential continues to grow across Asia and Africa, UK investors may find the stock an appealing choice for diversified exposure to high-growth economies. Prudential’s balanced approach of expansion, profitability, and shareholder returns positions it well for continued success in an evolving global landscape.

Thanks for reading,

Ollz

The information provided in this article is for informational purposes only and reflects my personal opinions and analyses. It should not be considered financial advice or a recommendation to buy or sell any securities. Investing in the stock market involves risks, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. I do not assume any responsibility for any financial losses or consequences that may arise from reliance on the information provided herein.