Is it time to diversify into renewable energy?

Bluefield Solar Income Fund: A Deep Dive into Risks and Opportunities in Renewable Energy

Introduction: Navigating Renewable Investments

Bluefield Solar Income Fund Limited (BSIF) is a London-listed investment trust that has established itself as a core player in the UK’s renewable energy landscape, with its primary focus on solar photovoltaic (PV) assets. Founded in 2013, BSIF’s mandate is to generate long-term, sustainable income for shareholders primarily through investments in solar energy projects, with a growing interest in battery storage and onshore wind assets. The company also seeks to provide stable and progressive dividends, appealing to income-seeking investors who value sustainable and predictable revenue streams.

Given its significant role in the UK renewable energy space, BSIF is an attractive option for UK investors focused on green investments, particularly in light of the UK government's push towards net-zero carbon emissions by 2050. In this comprehensive analysis, we’ll delve into BSIF’s financial health, dividend strategy, operational performance, and its long-term growth potential while highlighting the risks and challenges investors should consider before making an investment decision.

1. Financial Overview (FY 2024)

BSIF faced significant headwinds in FY 2024, largely due to operational disruptions, weather variability, and market-wide challenges in the renewable energy sector. Despite these hurdles, the fund maintained a commitment to progressive dividends and stable long-term income generation.

Dividend Performance and Stability

BSIF’s progressive dividend policy is one of its primary attractions, particularly for income-focused investors. In FY 2024, BSIF declared dividends of 8.80p per share, a modest increase from 8.60p in FY 2023. Despite operational setbacks, the fund has continued to maintain its dividend, supported by underlying earnings of 10.57p per share (after debt amortisation). The dividend coverage ratio stands at 1.36x, indicating that the company generates sufficient income to comfortably cover its payouts.

This level of dividend coverage is essential for long-term sustainability, particularly in a volatile sector like renewable energy where revenues can fluctuate due to changes in electricity prices, weather conditions, and regulatory environments. The company’s commitment to maintaining a high dividend yield (currently 8.3% based on its October 2024 share price of 108.40p) makes BSIF a compelling option for investors seeking stable income.

Dividend Growth and Coverage

Dividend Outlook

The Board has set a dividend target of 8.90p per share for FY 2025, a continuation of its policy to incrementally increase dividends in line with earnings. The total return to shareholders since inception now stands at 84.19%, underpinned by a combination of steady dividend payments and long-term capital growth.

2. Operational Performance: Solar, Wind, and Battery Storage

Solar Portfolio

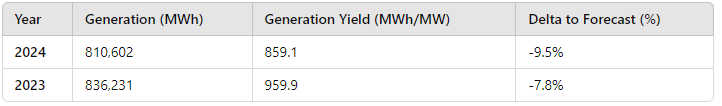

BSIF's solar portfolio remains the bedrock of its operations, comprising 129 photovoltaic (PV) plants across the UK, with a total installed capacity of 812.6 MW. The company’s solar assets generated 810,602 MWh of electricity in FY 2024, down 3% from the 836,231 MWh generated in FY 2023. This decline was primarily attributed to lower-than-expected irradiation levels (4.3% below forecast) and planned outages, including a targeted inverter replacement program. The operational performance was further affected by periods of extreme weather, particularly during July/August 2023 and May/June 2024.

Despite the operational challenges, BSIF’s investment in infrastructure upgrades, such as inverter replacements, has already shown signs of improving performance, and the company expects these investments to yield further improvements in FY 2025.

Solar Generation Performance

Wind Portfolio

In addition to solar, BSIF has expanded into wind energy. The company’s onshore wind portfolio consists of 135 wind installations, which generated 162.7 GWh in FY 2024, marking a significant 21.6% year-on-year increase. The wind portfolio benefited from improved availability and favorable wind speeds, which offset downtime due to component failures in certain turbines.

While wind represents a smaller portion of the company’s overall portfolio (7% of total capacity), it is a valuable diversification, offering counter-cyclical benefits to the solar assets. With the company continuing to repower some of its older turbines, the wind portfolio is expected to contribute increasingly to overall revenues.

Battery Storage and Development Pipeline

BSIF’s entry into battery storage is a key strategic move, positioning the company to capitalize on the UK’s growing need for grid balancing services, particularly as the country transitions to a higher reliance on intermittent renewable energy. The company has a development pipeline of 1.56 GW, which includes 603 MW of battery storage projects and 954 MW of solar projects.

These projects are in various stages of development and are expected to drive future growth while providing an additional revenue stream. Battery storage will allow BSIF to capture value from price volatility in electricity markets, storing energy when prices are low and selling it back to the grid when demand and prices are higher.

3. Strategic Initiatives: Capital Efficiency and Growth

Partnership with GLIL Infrastructure

One of the most significant developments for BSIF in FY 2024 was the formation of a strategic partnership with GLIL Infrastructure, announced in December 2023. This partnership is intended to help BSIF access additional capital while optimizing its capital allocation strategy. The partnership involved two major phases:

Phase One: BSIF co-invested in the acquisition of a 247 MW solar portfolio in the UK.

Phase Two: The company sold a 50% stake in an existing 112 MW solar portfolio to GLIL, generating £70 million in proceeds. This sale helped BSIF reduce its revolving credit facility (RCF) by £50.5 million, lowering overall leverage and freeing up capital for new investments.

This partnership underscores BSIF’s capital recycling strategy, where the company divests portions of its mature assets to fund the development of new, higher-growth opportunities. It also demonstrates BSIF’s ability to leverage partnerships with institutional investors to enhance its balance sheet and reduce risk.

Share Buyback Program

In response to the persistent discount to NAV, BSIF initiated a share buyback program in February 2024. By the end of June 2024, the company had bought back over 9 million shares at a cost of approximately £9.4 million. The buybacks added 0.4 pence per share to NAV, providing direct value to shareholders. As of September 2024, BSIF had repurchased over 14 million shares, narrowing the discount to 18%.

The buyback program, which continues into FY 2025, reflects management’s commitment to enhancing shareholder value and capital efficiency, particularly in light of the share price’s undervaluation relative to NAV.

*5yr Share price

4. Valuation and Share Price Performance

As of October 2024, BSIF’s shares are trading at 108.40p, representing a 19% discount to NAV. Historically, renewable infrastructure funds like BSIF have traded closer to NAV or even at a premium, due to the reliable income streams generated from long-term contracts, regulated revenues, and power purchase agreements (PPAs).

The current discount reflects broader concerns in the renewable energy sector, such as falling power prices and inflationary pressures. However, for value investors, this discount may represent an opportunity, as BSIF’s underlying assets are solid, and the company has shown a strong ability to manage its capital and operations efficiently.

Key Ratios for Valuation Analysis

5. Risks and Challenges

While BSIF offers substantial income potential and long-term growth, there are several risks and challenges that investors should be aware of:

1. Power Price Volatility

The decline in electricity prices has been a key challenge for BSIF in FY 2024. The company’s Power Purchase Agreement (PPA) strategy mitigates short-term volatility, as it locks in prices for 1-3 years. However, the falling spot electricity prices have weighed on overall earnings. BSIF has been able to lock in an average price of £149/MWh for FY 2024, down from £230/MWh in FY 2023, which has reduced revenue from unregulated energy sales.

2. Weather Dependence

BSIF's reliance on solar generation makes its performance highly dependent on weather conditions. Lower-than-expected irradiation levels in FY 2024 led to a 3% decline in solar output. While the company has diversified its portfolio with wind and battery storage, weather variability remains a key operational risk.

3. Inflation and Interest Rates

While inflation has moderated in 2024, BSIF’s costs have risen, particularly for debt servicing. However, the company’s long-term debt is largely fixed at low interest rates, which provides some protection. Rising interest rates could increase the cost of capital for future projects, but BSIF’s focus on deleveraging through asset sales and share buybacks helps mitigate this risk.

4. Sector-Wide Discount to NAV

The entire renewable energy sector is currently trading at a discount to NAV, reflecting investor concerns about power prices and regulatory risks. BSIF is no exception, with a 19% discount, though this could narrow as market sentiment improves.

6. Future Outlook and Growth Potential

BSIF’s long-term growth strategy is focused on continuing to build out its development pipeline, which includes 954 MW of solar projects and 603 MW of battery storage. These projects are expected to come online over the next few years, providing new revenue streams and enhancing the company's ability to navigate power price volatility.

With the UK government’s commitment to achieving net-zero emissions by 2050, the demand for renewable energy infrastructure is expected to grow, creating further opportunities for BSIF. The company’s strategic partnerships, prudent capital management, and diversification into battery storage position it well to capitalize on these trends.

Conclusion: A Balanced Opportunity for Long-Term Investors

Bluefield Solar Income Fund Limited (BSIF) continues to offer a compelling investment case for UK investors focused on stable, long-term income from renewable energy. Despite facing operational challenges and market pressures in FY 2024, the company has maintained its commitment to progressive dividends, with a current yield of 8.3%. The 19% discount to NAV may present an opportunity for value investors, particularly given the strength of the company’s underlying assets and its ability to manage capital efficiently.

The risks, particularly related to power price volatility and weather dependence, are real but manageable, given BSIF’s proactive operational strategy, its growing battery storage pipeline, and its ability to lock in revenue through PPAs. As BSIF continues to build out its development pipeline and benefit from strategic partnerships, the company is well-positioned to deliver solid returns in the long term.

For investors seeking exposure to the UK renewable energy sector with a focus on income generation and capital growth, BSIF offers a balanced opportunity that merits careful consideration.

Thanks for reading

Ollz