Dear Reader,

This week, I want to highlight a stock that came to mind after I listened to a recent interview with Terry Smith, CEO of Fundsmith. In the interview, Terry spoke about diversification—emphasising both its importance and the risks of being too diversified. I found it particularly interesting that he believes the optimal portfolio size is around 20 stocks.

That insight got me reflecting on my own portfolio. Am I diversified in the right way? Are there areas of the market I'm currently missing? More importantly, can I find stocks with strong fundamentals that also help broaden my exposure?

One stock I started thinking more seriously about after the interview is Invesco Bond Income Plus Limited (BIPS). It offers an interesting angle: exposure to the bond market through an equity investment in a listed investment trust.

Building on Terry Smith’s idea of being selective and strategic with portfolio allocation, this article takes a closer look at BIPS—a bond-focused investment trust listed on the FTSE 250. While often overlooked in favour of equity-heavy investments, bond-focused trusts can offer valuable diversification, income, and downside protection. In this piece, I’ll explore whether BIPS could be a smart addition to a well-constructed portfolio.

Company Overview:

Few investment trusts capture the spirit of income generation in today’s volatile markets quite like BIPS. BIPS has carved out a reputation for delivering a high level of dividend income and steady capital growth by focusing on high-yielding fixed-interest securities. With a portfolio spanning corporate bonds, subordinated financials, and select credit-intensive opportunities, BIPS stands out for its disciplined approach: investing only when the reward justifies the risk.

Recognised as the best investment trust in the ‘Bonds – Active’ category for two consecutive years, BIPS has maintained a robust dividend yield—recently around 6.7%—and a consistent payout record, making it a strong choice for investors seeking both income and resilience in uncertain times.

P.E: 12.40

Dividend yield: 7.03%

Price to Book: 1

Return on Assets: 7.1%

EPS: 0.136

Investment Strategy

BIPS has 3 main areas that they invest in:

Income Generators are bonds issued by non-financial companies with leveraged balance sheets, often in sectors like telecommunications, utilities, and consumer goods, providing attractive yields.

Banks and Subordinated Financials target bonds from financial institutions, particularly subordinated debt (jenior debt), which offers higher premiums due to regulatory requirements and complexity.

Credit Intensive Bonds involve investing in undervalued or distressed bonds that have the potential for recovery, typically in cyclical industries. This strategy allows the company to diversify risk while seeking high returns across various segments of the bond market.

In 2024, BIPS maintained a cautious strategy with three key moves:

Higher credit quality: 60% in BB-rated bonds (above benchmark average), reducing default risk but contributing to underperformance (8.5% NAV return vs. index’s 10.2%).

Selective currency bets: 85% GBP-hedged, but unhedged USD/EUR positions suffered from GBP strength.

Lower leverage: Gross gearing cut to 13.1% (from 15.8%) via repos, reflecting rate volatility caution.

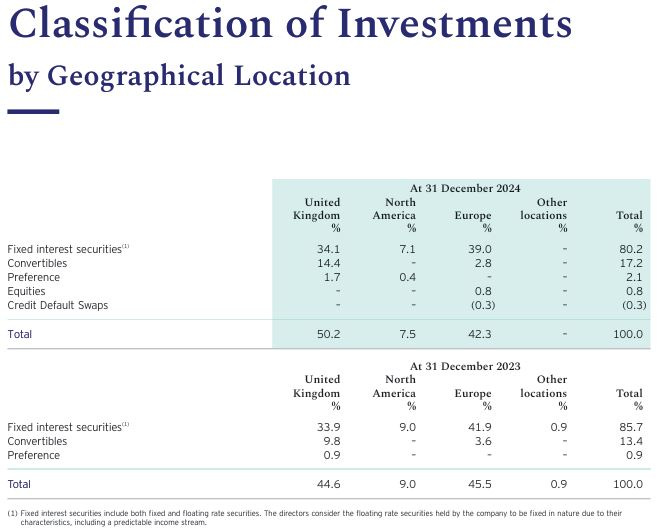

BIPS allocates its investments across different geographic regions, primarily focusing on developed markets like Europe and North America. Opportunities in emerging markets are also considered based on their relative risk-reward profiles. The geographic distribution is actively managed to adapt to shifting economic conditions and to capture potential value.

Top 5 holdings as of 2025:

The Fianancials:

Income Performance: BIPS reported a total investment income of £46.2 million in 2024, a 3.8% increase from £44.5 million in 2023. Interest income from fixed-income securities accounted for £42.1 million, with dividends contributing £4.1 million. Operating expenses were £3.1 million, representing 0.89% of average net assets. Net revenue available for distribution was £43.1 million. The dividend cover was 1.03x, and dividends paid totaled £41.8 million. The revenue reserve increased by £1.3 million.

Balance Sheet: The balance sheet showed net assets increasing to £345.8 million from £304.6 million in 2023. The net asset value per share rose from 168.58p to 170.87p. Gross and net gearing stood at 13.1% and 9.9%, respectively. Investments at fair value through profit or loss were £397.4 million.

Cash Flow: BIPS's cash from operations was £44.1 million after adjustments for non-cash items from a starting point of net revenue of £43.1 million. Investing activities saw a net cash outflow of £36.3 million. Financing activities included £13.7 million in cash inflows from the issuance of ordinary shares, while dividend payments resulted in a £41.8 million cash outflow.

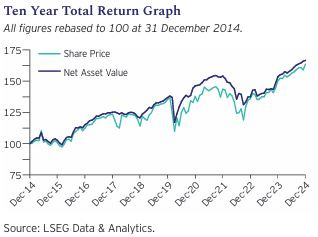

4. Growth

BIPS has demonstrated a commitment to delivering shareholder value. The company's Net Asset Value (NAV) and share price total returns, with dividends reinvested, reached 8.5% and 8.8%, respectively, in 2024. It has also increased its dividend for four consecutive years, announcing a dividend of 11.6875 pence per share for 2024, a 1.6% increase from 11.50 pence per share in 2023, and is targeting 12.25p per share for 2025. This is supported by a dividend yield of 6.7% and a dividend cover of 1.03x. Notably, BIPS shares traded at a premium for most of the year, closing at a premium of 1.8%, which led to the issuance of 21.7 million shares. Since its merger in May 2021, the company's shares have increased 20.2%.

In 2024, high-yield markets experienced steady progress, with credit spreads remaining at the lower end of historical ranges. Declining inflation allowed the Bank of England to ease monetary policy, cutting its Bank Rate from 5.25% to 4.75%. While UK economic growth was subdued, the US economy showed surprising strength, buoyed by consumer spending. BIPS's investment performance compared favorably with the ICE Bank of America Merrill Lynch European Currency High Yield Index over the longer term, with NAV total returns of 21.7% and 66.7% over five and ten years, respectively, compared to 20.4% and 60.0% for the Index.

Source for the above chart: “Why UK bond yields have spiked in 2025”

The performance of BIPS is also influenced by broader trends in the bond market, particularly the yields on benchmark government bonds. As depicted in the graph, UK and US 10-year yields moved in tandem throughout 2024 and into early 2025. These yields reflect investor sentiment towards inflation, economic growth, and monetary policy.

Risks and Challenges

BIPS, like any investment trust, faces a range of risks and challenges. One notable challenge is the potential for underperformance relative to benchmark indices. In 2024, BIPS's NAV return of 8.5% lagged the ICE Bank of America Merrill Lynch European Currency High Yield Index's 10.2%, partly due to a more conservative approach, including higher credit quality holdings and currency hedging strategies.

Furthermore, currency fluctuations can impact returns, particularly from unhedged positions, as demonstrated by the negative impact of a strong GBP in 2024. Economic uncertainties, shifts in monetary policy, and broader market volatility also pose ongoing risks, potentially affecting bond valuations and investor sentiment.

Pound Dollar Exchange Rate (GBP USD) 5yr Chart:

Valuation and outlook

Keep reading with a 7-day free trial

Subscribe to Going Long to keep reading this post and get 7 days of free access to the full post archives.