Dear reader,

Last week on the stock market was a tough one. It seems miners and in particular gold miners suffered last week. Whenever there are big falls in share prices and across the market I aways like to look at what is cheap and am I willing to buy it?

So, watching the biggest fallers allows me to either have new ideas or revisit old ideas. I have always liked the idea of a contrarian view where the strategy is to go against the current market trends. People argue that Warren Buffet has a contrarian view and also his most famous views are his value investing.

But dear reader, back to the topic at hand. Inflation……

FTSE 100 biggest fallers of last week.

Inflation numbers:

As the Bank of England released their inflation numbers, it’s always good to understand how this can have an effect on gold miners. One stock I like to buy are cheap gold miners so reader, it’s always pays to understand the macro environment that can affect these stocks.

In December 2023, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 4.2%, matching November's rate. The monthly CPIH increase was 0.4%, consistent with December 2022.

The Consumer Prices Index (CPI) increased to 4.0% in the 12 months to December 2023, up from 3.9% in November, marking the first rise since February 2023. The monthly CPI increase for December 2023 was 0.4%, similar to December 2022.

Alcohol and tobacco contributed significantly to the upward change in both CPIH and CPI annual rates, while food and non-alcoholic beverages had the largest downward impact.

Core CPIH (excluding energy, food, alcohol, and tobacco) remained at a 5.2% increase in the 12 months to December 2023, with goods slowing to 1.9%, and services remaining at 6.0%. Core CPI (excluding energy, food, alcohol, and tobacco) also stayed at a 5.1% increase, with goods at 1.9% and services increasing slightly to 6.4%.

How can inflation impact the price of gold?

Inflation can impact the price of gold in various ways:

1. Preserving Wealth: Gold serves as a hedge against inflation, maintaining its value when currency purchasing power declines. Its limited supply makes it an attractive option during periods of rising inflation.

2. Real Returns: Gold historically provides positive real returns during inflation, protecting investors from negative effects. It ensures that investments outpace inflation, preventing a decrease in real returns.

3. Dollar Depreciation: As inflation rises, central banks may employ measures like low-interest rates, leading to the depreciation of the U.S. dollar. Since gold is priced in dollars globally, its value in dollars may increase during inflation.

4. Safe-Haven Demand: During economic uncertainty or high inflation, gold is sought after as a safe-haven asset. Its perceived stability in turbulent times increases demand, influencing its price upward.

5. Interest Rates: Inflation and interest rates are linked. Central banks may raise rates to counter inflation, making interest-bearing assets more appealing. Conversely, low interest rates reduce the opportu

nity cost of holding gold, making it more attractive.

Gold price over 20 years:

Price of gold over a 20-year period.

Lastly reader and one final point is that many see gold as a precious metal to use in their jerually. However, gold, over a 20-year period is at all-time high. If inflation rates don’t lower, I think we could see the gold price going up. The Fed has a target of 2% and the current projection is 3.1%. When inflation rates rise the gold price is likely to rise as well.

So as the turbulent times keep coming and the prices of miners are increasingly fluctuating, we want to see if we can get any cheap ones.

FTSE Gold Miners Index:

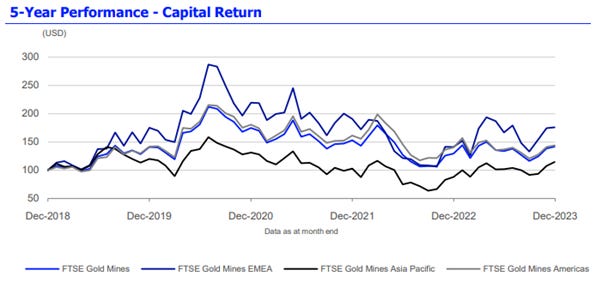

We can track the overall gold miner’s performance on the FTSE on a 5-year performance basis. Notably September 2022 was a one of the lowest points across all performance measures. Now looking the performance, we can see improvements

We can track the overall gold miner’s performance on the FTSE on a 5-year performance basis. Notably September 2022 was a one of the lowest points across all performance measures. Now looking the performance, we can see improvements.

Buying, buying and buying….

Investors can buy either an index like this, or induvial miners or even the gold product itself. Its always important to note that buying the last two will involve more risk as gold and the induvial miners will fluctuate more. However, that being said if an investor was able to do analysis on individual miners and for example can see that they have no debt, brining in lots of cash and pay a good dividend etc, the opportunity can be great.

One book recommendation:

So dear reader, I would advise you all to read one book I like on commodities. It called the guide to commodities: producers, players and prices, markets, consumers and trends by Caroline Bain (The economist). This book really heled me understand all the different commodities in more depth and is a great asset to any investors library.

Thanks for reading and do let me know what you think!

1Trueinvesting.