Dear reader,

If you've seen The Big Short or read the book, you'll know that Michael Burry founded the hedge fund Scion Capital. He is best known for being one of the few investors to foresee and profit from the subprime mortgage crisis of 2007. Burry made approximately $100 million personally, while earning his investors around $725 million.

Additionally, Steve Carell's character in the film is based on the real-life Mark Baum, managing director of FrontPoint Partners. The actual FrontPoint Partners reportedly made around $1 billion from their short positions on collateralised debt obligations (CDOs).

So, why do I bring up The Big Short?

Well, first of all—it’s a brilliant film. Sharp, fast-paced, and funny for a movie about credit default swaps. It offers a rare window into the inner workings of hedge funds during one of the most chaotic financial periods in modern history. It shows how a handful of outsiders—people like Michael Burry and the team at FrontPoint Partners—saw the storm coming when almost everyone else was blind.

Hedge funds like those portrayed in The Big Short operate in a world that’s often opaque to the average investor. They take bold, high-conviction positions, sometimes betting against the herd, and when they’re right, the payoff can be extraordinary. But they’re also risky, secretive, and expensive to get into.

In this article, I want to dig into one hedge fund you've almost certainly heard of—Pershing Square Capital Management, led by Bill Ackman. We’ll explore what it means to be an investor in a hedge fund like this: the advantages, the drawbacks, and whether it’s worth it.

How does a hedge fund work?

Diffrent Hedge Fund strategies:

The Strategic Role of Hedge Funds in Investment Portfolios

A look into Pershing Square Capital Management

Are hedge funds worth buying?

Notable Campaigns by Pershing Square Capital Management

Hedge Funds as Catalysts: Recent High-Impact Campaigns

Conclusion: Are Hedge Funds Worth It?

How does a hedge fund work?

Put simply, a hedge fund is a type of investment vehicle that pools capital from wealthy individuals or institutions and uses a wide range of strategies to try and generate high returns. These strategies can be quite aggressive, often involving short selling, leverage, derivatives, and arbitrage. In essence, hedge funds are willing to take on higher risk in pursuit of higher reward.

One key thing to note about hedge funds is their fee structure. Unlike traditional funds, they typically charge significantly more—commonly a 2% annual management fee, plus 20% of any profits generated (known as “two and twenty”). These high fees are part of the trade-off for access to potentially outsized returns and sophisticated investment strategies.

^ taken from : “Hedge Fund Fees, Types, and Structures” - Preqin

Different Hedge Fund strategies:

Quantitative

Renaissance Technologies and Two Sigma are leaders in quantitative hedge fund strategies. These firms use complex mathematical models and big data to identify trading opportunities. Renaissance, for example, is famous for its Medallion Fund, which relies on algorithms and statistical analysis to execute thousands of trades daily, seeking to profit from small price inefficiencies.

Event-Driven

Elliott Management is well known for its event-driven strategy, which focuses on opportunities arising from corporate events like mergers, restructurings, or bankruptcies. By analysing how these events affect company valuations, Elliott seeks to profit from price movements before and after such catalysts.

Global Macro

Bridgewater Associates, led by Ray Dalio, is a standout in the global macro space. This strategy involves making large bets on economic trends across asset classes like stocks, bonds, currencies, and commodities. Bridgewater’s “All Weather” approach is designed to perform in various market environments by diversifying risk across different economic scenarios.

Multi-Strategy

Millennium Management and Citadel Advisors exemplify the multi-strategy model. These funds run multiple investment teams, each pursuing different strategies such as equities, fixed income, macro, and arbitrage. By diversifying across approaches, they aim to deliver more consistent returns and adapt quickly to changing markets.

3 . The Strategic Role of Hedge Funds in Investment Portfolios

Hedge funds can add a valuable dimension to portfolio construction by offering access to strategies that are less correlated with traditional markets. With tools like short selling, leverage, and exposure to niche asset classes, they allow investors to diversify beyond simple stock and bond allocations. When used thoughtfully, they can help smooth volatility, hedge macro risks, or generate alpha through specialist strategies.

Pershing Square provides a strong case study in how hedge funds can play a more active, high-conviction role. Rather than diversifying widely, the fund concentrates on a small number of North American companies it believes are mispriced—taking sizeable stakes to influence change from within. Its investment in Canadian Pacific, where it helped drive a turnaround by overhauling management, or its more recent involvement in Howard Hughes Corporation, show how activism can unlock long-term value. These aren’t passive bets—they are hands-on campaigns backed by deep research and a willingness to engage.

For allocators, the relevance of a fund like Pershing lies not just in returns, but in philosophy. This is investment as stewardship—where alignment with shareholders, concentrated conviction, and a readiness to challenge the status quo combine to offer something traditional portfolios rarely can.

Pershing Square Capital Management

Pershing Square Capital Management is a prominent hedge fund founded in 2004 by Bill Ackman, a high-profile American investor known for his activist investment style. Headquartered in New York City, the firm manages several billion dollars in assets, primarily on behalf of institutional investors and high-net-worth individuals.

Pershing Square is best known for its concentrated, high-conviction portfolio—meaning it doesn’t spread its bets thinly across dozens of stocks. Instead, it focuses on a small number of carefully researched positions, often in large-cap companies, and sometimes takes an activist approach to unlock value. This might involve pushing for board changes, strategic shifts, or even full company overhauls. Under Ackman’s leadership, the fund has experienced both major wins and public missteps, but has maintained a strong long-term track record.

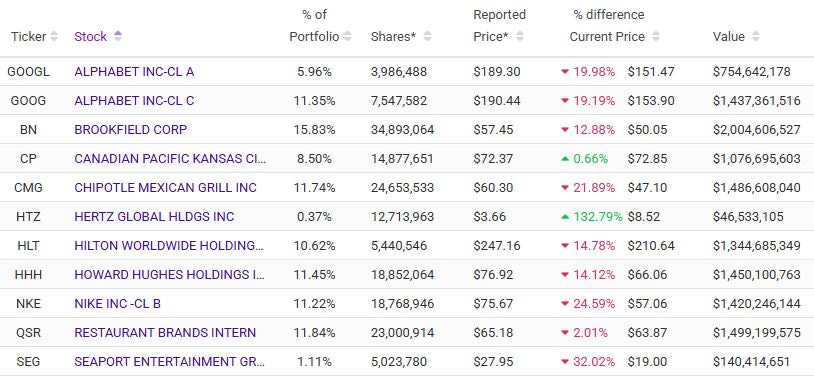

Pershing Square’s top five holdings reflect its high-conviction approach, with significant allocations to well-established North American businesses. As of the latest disclosure, the fund’s largest positions are: Brookfield Corporation (BN) at 15.83%, Restaurant Brands International (QSR) at 11.84%, Chipotle Mexican Grill (CMG) at 11.74%, Howard Hughes Holdings (HHH) at 11.45%, and Alphabet Inc. Class C (GOOG) at 11.35%.

Current holdings as of Q4 2024:

Pershing Square performance:

Pershing Square Holdings experienced significant growth over the past five years. The share price increased by 128.15%, while the NAV rose by 123.03%. This reflects strong performance, particularly notable from 2020 to early 2022, with steady gains continuing through 2025.

However, the discount chart shows that Pershing Square traded at a discount during this period, ranging from -15.44% to -55.44%. This discount suggests that while the underlying investments of the fund performed well, the market valued the fund's shares at less than their net asset value.

Are hedge funds worth buying?

For investors seeking differentiated sources of return, hedge funds can still play a meaningful role—if selected carefully. While the asset class has faced criticism in recent years for high fees and patchy performance, certain managers have continued to outperform, particularly those with concentrated, high-conviction strategies. Take Pershing Square Capital Management under Bill Ackman, for instance. Despite some well-publicised missteps in the past, the fund has delivered a 198% return over the past decade, compared to 86% from the SPDR S&P 500 ETF, highlighting the potential value that skilled active management can bring when aligned with bold, research-led conviction.

That said, hedge funds are not a one-size-fits-all solution. The “2 and 20” fee structure, limited transparency, and liquidity constraints can be significant drawbacks—especially in a world where low-cost passive strategies continue to gain ground. But for long-term investors with access to top-tier managers and a tolerance for less frequent liquidity, hedge funds can offer true alpha, downside protection, and access to alternative strategies such as event-driven investing, long/short equity, or activist engagement. As with any asset class, manager selection is critical. When done right, hedge fund exposure can enhance a portfolio’s risk-return profile—and justify the premium.

In an article on Substack by “Klement on Investing,” Joachim Klement argues:

“You can compare the performance of the 60/40 portfolio with different hedge fund strategies… but most strategies' results aren’t flattering. Macro hedge funds, on average, underperformed the 60/40 portfolio by 2.3% per year, while event-driven hedge funds were about the same as the 60/40 portfolio. Equity hedge strategies slightly outperformed (by 0.3% per year), reflecting the stock market's strong performance in recent years.”

While recent studies suggest the average hedge fund has struggled to outperform a traditional 60/40 stock-bond portfolio—especially after fees—it’s important to distinguish between aggregated returns and the more nuanced reality of hedge fund investing. As Klement notes, a $100 investment in a typical hedge fund from 2014 would have grown to $161 by early 2025, while a passive 60/40 portfolio would have reached $166 before costs. At face value, this raises valid questions around cost-effectiveness. But few allocators deliberately seek out the “average” hedge fund—just as no one aims to buy the median mutual fund.

In practice, investors pursue high-conviction managers with a demonstrable edge: those who exploit inefficiencies, take idiosyncratic positions, and pursue uncorrelated strategies—be it merger arbitrage, distressed credit, global macro, or long/short equity. These are exposures that a plain-vanilla 60/40 allocation simply can’t replicate. While broad indices inevitably dilute these outliers, selective exposure to differentiated hedge funds—such as Pershing Square, Elliott Management, or Bridgewater—can still offer attractive diversification and asymmetry, particularly in markets characterised by dispersion or macro dislocation.

That said, Klement’s point on risk-adjusted returns is well taken. The Sharpe ratio comparison underscores that, for most of the past decade, hedge funds have struggled to justify their fees on a portfolio-wide basis. Moreover, the diversification benefit—often cited as a key selling point—has been inconsistent over rolling 12-month horizons.

In short, hedge funds shouldn’t be dismissed, but nor should they be treated as a one-size-fits-all solution. They are best viewed as specialist tools rather than portfolio anchors—capable of adding value in specific regimes, but highly dependent on manager selection, strategy alignment, and disciplined cost control. For long-term allocators, the challenge isn’t whether hedge funds are worth it—it’s knowing which ones are, and when.

Notable Campaigns by Pershing Square Capital Management

Successful Campaigns

Canadian Pacific Railway (2012–2016)

This is often cited as Pershing Square’s most successful activist campaign. Ackman acquired a 14.2% stake in 2012, agitated for board changes, and successfully installed Hunter Harrison as CEO. Under Harrison’s leadership, CP’s operating ratio improved from ~81% in 2011 to ~58% by 2016—one of the best in the industry. Revenues grew steadily, but the real transformation came in profitability: net income rose from CAD 570 million in 2011 to over CAD 1.6 billion in 2016. The share price more than tripled during Pershing’s involvement, rising from ~CAD 50 to over CAD 200, generating billions in returns for Pershing.Chipotle Mexican Grill (2016–present)

After food safety incidents hit both brand and stock (which had halved from its 2015 peak), Pershing Square disclosed a 9.9% stake in September 2016, valued at around $1.2 billion. Ackman pushed for governance reform and operational overhaul. The founder-CEO stepped down in 2017, and Brian Niccol (ex-Taco Bell) was brought in. Since then, revenue has grown from $4.5 billion in 2016 to over $9.9 billion in 2023. The stock, which traded near $400 when Ackman entered, hit over $3,000 in early 2025—an approximate 7.5x return, not including any share buybacks.

Unsuccessful Campaigns

Valeant Pharmaceuticals (2015–2017)

This campaign represents one of the most high-profile failures in hedge fund history. Ackman invested over $3 billion in Valeant, believing its roll-up model and aggressive cost-cutting could deliver durable EPS growth. Initially, the bet paid off—shares surged from under $100 to over $260. But scrutiny over pricing practices and opaque accounting led to a collapse. By early 2017, shares were under $15. Pershing Square exited the position, crystallising a loss of around $4.1 billion. Ackman later called it “the worst investment of his career.”Herbalife (2012–2018)

A highly controversial $1 billion short bet, Ackman alleged Herbalife operated as a pyramid scheme. Despite extensive lobbying and presentations, regulatory action never materialised. Meanwhile, activist investor Carl Icahn took the opposing bet, acquiring a 25% stake and supporting management. The result was a drawn-out public feud and an epic short squeeze. Herbalife shares doubled during Pershing’s involvement, forcing Ackman to exit in 2018 with heavy losses—reportedly in the hundreds of millions. The campaign became a cautionary tale in the risks of public activist short-selling.

Hedge Funds as Catalysts: Recent High-Impact Campaigns

Elliott Management & BP (2024)

Elliott Management’s 5% stake in BP is a textbook example of activist influence—particularly striking in a UK-listed blue chip. For years, BP positioned itself as a climate transition leader, pledging a 40% reduction in oil and gas output by 2030 and committing billions to renewables. Elliott’s entry in early 2024 altered that trajectory. Under pressure from the hedge fund, BP softened its green targets, cut back on renewable capex, and reaffirmed its focus on upstream oil and gas—aiming to deliver higher near-term returns. The market reaction was immediate: BP shares rose nearly 10% within weeks of Elliott’s stake disclosure, reflecting investor appetite for cash-generative, core energy operations over long-dated ESG promises. It’s a sharp reminder that even a minority stake can recalibrate boardroom strategy in today’s market.

TCI Fund Management & Alphabet (2023–present)

Closer to home in terms of ownership structure, but global in impact, is the campaign by London-based TCI Fund Management against Alphabet. In late 2022, TCI (run by Sir Chris Hohn) criticised Alphabet’s ballooning cost base, specifically its overstaffing and spending on loss-making ventures such as Waymo and Verily. Holding a stake worth over $6 billion, TCI demanded workforce reductions and tighter capital discipline. Alphabet responded swiftly—cutting 12,000 jobs in early 2023 and scaling back its “Other Bets” division. The result: Alphabet’s share price rallied over 40% in the following 12 months, regaining ground against more disciplined tech peers. TCI’s intervention underlined how even well-capitalised tech giants are not immune to shareholder activism—especially when returns are under scrutiny.

Conclusion: Are Hedge Funds Worth It?

Hedge funds can be useful, but they’re not for everyone. For retail investors, they often seem exciting—promising big returns and clever strategies—but the reality is they can be expensive, risky, and hard to get into. Unless you’re very wealthy or have access to specialist funds, a better approach might be to look at listed alternatives or diversified funds that use hedge fund-like strategies in a more accessible way.

For fund managers and professionals, hedge funds can play a valuable role in a wider portfolio—especially when you're looking to reduce risk through diversification or try to beat the market. Strategies like long/short investing or activism, as used by firms like Pershing Square, can add an extra layer of flexibility and insight. But the risks, fees, and complexity mean they need to be chosen with care.

Hedge funds can offer real advantages, but they aren’t a silver bullet. Whether you're an individual or managing a fund, it's crucial to be clear on what you're trying to achieve—and to make sure the hedge fund you pick is the right fit for your goals and risk tolerance.

While hedge funds aren't suitable for everyone, understanding how they operate—and which managers truly add value—can offer powerful lessons for any investor

Thanks for Reading,

Ollz

Further Reading:

https://www.cfainstitute.org/insights/professional-learning/refresher-readings/2025/hedge-fund-strategies

https://www.trustintelligence.co.uk/investor/articles/guides-investing-in-hedge-funds-with-investment-companies-oct-2024

https://www.morningstar.co.uk/uk/news/AN_1739529108574519000/activist-elliott-management-third-biggest-investor-in-bp-%E2%80%94-reports.aspx

The information provided in this article is for informational purposes only and represents my personal opinions and analysis. It should not be construed as financial advice or a recommendation to buy or sell any securities. Investing in the stock market carries risks, and past performance is not necessarily indicative of future results. Readers are strongly encouraged to carry out their own research and seek advice from a qualified financial advisor before making any investment decisions. I do not accept any responsibility for any financial losses or consequences that may arise from reliance on the information presented in this article.