Hidden value in Digital 9 Infrastructure?

A Comprehensive Analysis of Recent Developments, RNS Updates, and Financial Reports

Introduction

Digital 9 Infrastructure plc (LSE: DGI9) is a leading UK-listed investment trust that focuses on building and operating a portfolio of digital infrastructure assets, including data centers, subsea fiber networks, and wireless towers. As digital connectivity becomes increasingly crucial for the global economy, Digital 9 aims to capitalize on the long-term demand for infrastructure that supports internet usage and data transmission. However, the company’s recent financial strategies and acquisitions have raised questions around sustainability, particularly regarding its debt load and dividend policies.

In this article, we will analyze Digital 9’s recent activities by summarizing key industry articles, analyzing their most recent RNS updates, and reviewing their latest financial performance. This will provide investors with a comprehensive understanding of the company’s current state, opportunities, and challenges.

Managed Wind-Down Announcement

In a significant development, Digital 9 Infrastructure its decision to pursue a managed wind-down. This decision came after thorough consultation with its financial advisers, feedback from a large number of shareholders, and considerations around the company’s £375 million revolving credit facility (RCF).

The company plans to dispose of its key assets, including Aqua Comms, EMIC-1, Elio Networks, SeaEdge UK1, and its stake in Arqiva. The disposal process will be initiated following the approval of a resolution at the upcoming General Meeting.

Asset Disposal Strategy:

Wholly-Owned Assets: Sale preparations for these assets, including Aqua Comms, will commence immediately after the resolution is passed. Competitive sale processes are expected later in the year.

Arqiva: The Board has taken a more cautious approach regarding the sale of its stake in Arqiva, considering that maximising value could take longer. While open to value-accretive opportunities, the company has deferred the sale process for now.

Key Objectives of the Managed Wind-Down:

Orderly Asset Disposal: The company aims to sell its assets in a way that maximises shareholder value while considering the ongoing costs of managing the portfolio.

New Investment Policy: The revised investment policy focuses on realising the assets and returning cash to shareholders. The first priority will be to repay the RCF before distributing any further proceeds.

Dividend Distribution: The company has suspended dividend payments for the near term, with future distributions likely to come in the form of capital returns rather than regular dividends.

This strategic pivot is a crucial development for investors, as it signals the Board's intent to focus on maximising asset value through a structured, phased sale of its portfolio rather than continuing its previous investment strategy.

Analysis of Recent RNS Updates

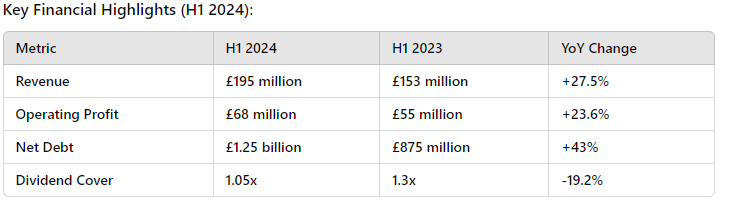

Interim Results for H1 2024

Digital 9’s interim results for the first half of 2024, released in September, revealed strong revenue growth, primarily driven by its core assets in data centers and subsea cable networks. The company reported a 27.5% year-on-year increase in revenue, reflecting the impact of its recent acquisitions, including Aqua Comms. However, the results also highlighted significant challenges, particularly regarding debt levels and dividend coverage.

The company's net debt increased by 43%, rising to £1.25 billion, primarily due to acquisition-related borrowing. This has put pressure on the company's cash flow, and its dividend cover dropped to 1.05x from 1.3x a year earlier, raising concerns about the sustainability of its current dividend policy.

Key Points:

Revenue Growth: The company’s revenue growth was primarily driven by its recent acquisitions, which contributed significantly to its top line.

Rising Debt: The 43% increase in net debt is a direct result of the company's acquisition strategy, which has led to concerns about its leverage and ability to manage its financial obligations.

Dividend Coverage: The decline in dividend coverage is notable, as it suggests that the company may face difficulties maintaining its current dividend payouts if earnings growth does not keep pace with debt servicing requirements.

Management Commentary:

Digital 9’s management remains optimistic about the company's long-term prospects, citing the essential nature of its assets and the continued growth in demand for digital infrastructure. However, management has acknowledged the need to carefully manage the company's debt levels and cash flow generation to ensure long-term financial stability.

Capital Raising Initiatives

In August 2024, Digital 9 announced a significant capital raise, issuing new shares to generate £250 million in proceeds. The capital raising was conducted to reduce the company's debt levels and to provide additional liquidity for future acquisitions. This move was viewed positively by the market, as it demonstrated the company's commitment to addressing its balance sheet concerns while continuing to pursue growth opportunities.

Key Points:

Capital Raise: The rights issue raised £250 million, providing the company with additional liquidity to fund further acquisitions and reduce its leverage.

Use of Proceeds: The proceeds will be used to acquire new digital infrastructure assets, as well as to reduce the company’s debt levels.

Market Response: Investors reacted positively to the capital raising initiative, as it signaled the company’s commitment to balancing growth with financial prudence.

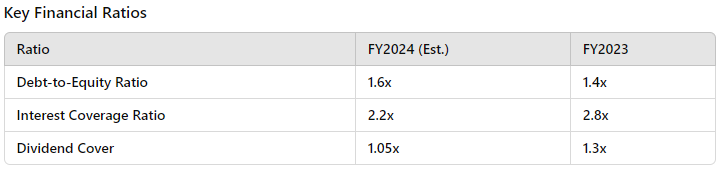

Financial Report Analysis

Digital 9’s financial performance in FY2024 highlights the company’s growth trajectory, but it also underscores the challenges associated with managing rising debt levels and maintaining dividend sustainability. The company’s aggressive acquisition strategy has led to impressive revenue growth, but it has also raised concerns about its ability to generate sufficient cash flow to cover its financial obligations.

Financial Summary:

Revenue Growth: Digital 9 is expected to achieve a 25.8% increase in total revenue for FY2024, driven by its recent acquisitions, particularly in subsea fiber and data centers.

Debt Levels: The company’s rising debt levels remain a concern, as the debt-to-equity ratio is projected to rise to 1.6x, up from 1.4x in the previous year.

Dividend Sustainability: While Digital 9’s dividend yield remains attractive, the declining dividend cover and rising debt levels suggest that future dividend payments may be at risk if the company does not improve its cash flow generation.

The Share Price over 5yrs:

Digital 9 Infrastructure’s share price has been significantly impacted over the past year, reflecting the company’s strategic challenges and market uncertainties. As of October 2024, the stock has seen a substantial decline, driven by several key factors:

Declining Investor Confidence: The company's decision to pursue a managed wind-down announced in January 2024 has contributed to reduced investor confidence. The market has reacted to the uncertainty surrounding the disposal process of its key assets, leading to a sustained sell-off in the months following the announcement.

Broader Market Volatility: The global infrastructure sector has been affected by rising interest rates, inflationary pressures, and concerns over recession risks, adding downward pressure on the share price. Digital 9, with its high leverage and reliance on debt financing, has been particularly sensitive to these macroeconomic trends.

As of mid-October 2024, Digital 9 Infrastructure's share price is approximately 17.94p per share, having seen a significant decline over the past 12 months. The stock's 52-week high was 54p, with a low of 14.5p. This represents a drop of more than 60% from its peak, reflecting broader concerns about the company's heavy debt load and ongoing restructuring efforts

Despite these challenges, some investors view the company's current valuation as an opportunity, particularly if its asset disposal strategy proves successful. The recent insider buying by key figures at InfraRed Capital Partners suggests confidence in the upside potential

What Have the Investment Writers Been Saying?

Link→Infrastructure Investor: Strategic Acquisitions. (Published: September 2024)

Infrastructure Investor released a detailed analysis in September 2024 on Digital 9’s strategy, focusing on its acquisition of Aqua Comms, a subsea fiber-optic cable operator. The article emphasizes how subsea cables, which handle 99% of global internet data traffic, are a critical part of the company’s infrastructure portfolio. Aqua Comms' assets, such as the AEConnect-1 system, significantly boost Digital 9’s footprint in the global digital infrastructure market.

Key Takeaways:

Subsea cables are vital for global internet connectivity.

Aqua Comms adds long-term, steady cash flows.

Digital 9 is expanding its presence in transatlantic connectivity.

Analysis: The strategic acquisition of Aqua Comms positions Digital 9 as a major player in the digital infrastructure space. However, maintaining and expanding subsea cable networks requires continuous capital investment, potentially straining the company’s finances. While the long-term benefits are clear, the challenge will lie in managing operational costs and finding a balance between profitability and the need for ongoing investment. If Digital 9 can effectively manage these costs, the acquisition will prove to be a key pillar of future growth.

Investment Week: Dividend Coverage Concerns (Published: October 2024)

In October 2024, Investment Week raised concerns about Digital 9’s ability to maintain its dividend payouts amid rising debt levels. The company has maintained its dividend yield, which currently stands at around 6.5%, but analysts are questioning the sustainability of these payments due to the company’s aggressive acquisition strategy and increasing debt-servicing costs.

Key Takeaways:

Concerns are growing over whether dividends can continue without the need for borrowing.

Debt is rising, and the company may face tough choices between growth and dividends.

The long-term viability of dividends depends on how quickly earnings can outpace debt repayments.

Analysis: Digital 9’s dividend yield makes it an appealing choice for income-focused investors, but the increasing debt load presents significant risks. While management has prioritized maintaining dividend payments, the reliance on debt financing for acquisitions raises concerns about long-term sustainability. Should interest rates rise or earnings underperform, the company may be forced to reduce its dividend payouts. Investors should carefully monitor whether management can strike a balance between growth ambitions and financial stability, ensuring that dividends remain covered by organic cash flow rather than further borrowing.

Trustnet: Long-Term Growth Prospects and Short-Term Challenges (Published: October 2024)

Trustnet’s October 2024 report highlights Digital 9’s strong long-term growth potential due to its exposure to critical digital infrastructure. However, the company’s aggressive acquisition strategy has led to worries about its cash flow and debt management, especially given rising interest rates and operational challenges.

Key Takeaways:

Digital infrastructure assets, such as data centers and wireless towers, are critical for the digital economy.

The company faces short-term pressures related to debt and liquidity.

Digital 9’s long-term growth depends on its ability to balance acquisitions with prudent financial management.

Analysis: Digital 9 is positioned to benefit from the increasing global reliance on digital infrastructure, but the company’s aggressive acquisition strategy has created financial challenges. In the short term, the company’s ability to generate sufficient cash flow to service its debt and fund future acquisitions will be critical. Rising interest rates could exacerbate liquidity pressures, and any failure to effectively manage these financial obligations could hinder future growth. Investors will need to weigh Digital 9’s long-term potential against these short-term financial risks.

Conclusion

Aqua Comms Acquisition: The purchase of Aqua Comms solidifies Digital 9’s position in the global digital infrastructure market, offering long-term revenue stability through subsea fiber-optic cables that handle 99% of global internet data transmission.

Debt Pressure: Despite growth, Digital 9's reliance on debt financing is raising red flags, particularly with its dividend sustainability under scrutiny. Investors are concerned about its ability to maintain dividends amidst rising debt levels and the increased cost of borrowing.

Dividend Concerns: While the company offers an attractive 6.5% dividend yield, questions remain over its long-term sustainability due to significant cash outflows and potential pressure on earnings.

Investor Outlook: For long-term investors, Digital 9’s assets in data centers, subsea cables, and wireless towers provide exposure to a rapidly growing sector. However, short-term risks like cash flow challenges and rising interest rates need careful monitoring.

Thanks for Reading

Ollz

Disclaimer: This article is for informational purposes only and should not be considered as financial or investment advice. Readers are encouraged to conduct their own research or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results, and all investments carry risks. The analysis provided is based on publicly available information and does not constitute a recommendation to buy or sell any security.

I agree with your point. However, there's potential value in the wind-down of Digital 9 Infrastructure, provided they can sell their assets at favorable prices. The main concern lies in whether they can achieve this. As of now, no specific date for delisting has been announced, meaning they are focusing on asset sales to manage their debt obligations. Successfully doing so should buy them more time to secure better prices for remaining assets, ultimately maximizing value for investors

Thanks for the article, although I'm slightly confused as if Digital 9 is in managed wind-down, I don't think there's much growth prospect ahead. From what I've read they've just replaced the former manager, Triple Point, that got into this mess, with InfraRed, and InfraRed is focused on selling off the remaining assets. There could be some value here if the assets sell for more than what the market is currently pricing in - and the recent purchases of shares by InfraRed execs may be a positive signal for that. But Digital 9 is still in forced seller mode, and that's not a good position. Personally I'm staying well clear!