Dear reader,

This week, we’re diving into Greggs – famous for its iconic sausage roll and a staple on British high streets. I’ve seen plenty of people writing about it here on Substack, and for good reason. Despite what appeared to be positive news, the stock has dropped. In such a challenging market, businesses need to be well-managed and demonstrate real resilience.

In this article, we’ll cover 7 key points about Greggs, breaking down what’s going on and what it could mean for investors.

Company Overview

Financial Performance

Growth

Market & Competitive Landscape

Strategic Initiatives & Expansion

Risks & Challenges

Valuations & Outlook

1. Company Overview

Total Sales Growth: 11.3%

P.E: 12.28

Dividend yield: 3.70%

Price to Book: 3.92

EV/EBITDA: 7.59

1.a Overview of the business model

Retail sales (90% of revenue): 2,600+ shops nationwide selling freshly prepared food-on-the-go.

Manufacturing: Own supply chain and production facilities for cost control.

Digital channels: App, Click & Collect, and delivery partnerships driving growth (5% of revenue).

Wholesale (5% of revenue): Supplying external retailers.

Focus on value, quality, and convenience with strong brand loyalty.

Revenue £2.01B in 2024, up 11.32% YoY. Targeting 3,000+ shops.

2. Financial Performance

As mentioned above, the company is trading at relatively low multiples. With a price-to-earnings (P/E) ratio of 12.28, it appears undervalued relative to its earnings. What’s more, its five-year lows sit around c.£11.50, while as of today (11/03/2025), it’s trading at approximately c.£19.09.

The Oak Bloke sums it up nicely:

The share today costs you £18.50. The same share in 2020 at Covid Lows would’ve cot £14.50”.

Income Statement: Greggs delivered strong results in 2024, with total sales reaching £2,014.4 million, an 11.3% increase from 2023. The company's underlying profit before tax grew by 13.2% to £189.8 million, demonstrating solid profitability. Underlying diluted earnings per share also improved by 11.1% to 137.5p. These figures indicate robust top-line growth and improved operational efficiency.

Balance Sheet and Cash Flow: Greggs maintains a healthy financial position with a net cash balance of £125.3 million at the end of 2024. While this is down from £195.3 million in 2023, it reflects significant capital investments made during the year. The company generated a strong net cash inflow from operating activities after lease payments of £254.2 million, slightly lower than the £257.1 million in 2023. This cash generation supports Greggs' ambitious growth plans and dividend policy.

Capital Expenditure: Greggs is investing heavily in growth, with total capex increasing to £249.0 million in 2024, up from £199.8 million in 2023. The company plans to invest £300.0 million in 2025, focusing on supply chain capacity expansion and new shop openings.

Dividend Policy: Greggs maintains an attractive ordinary dividend, covered 2x by earnings. The total dividend for 2024 is 69.0p per share, up 11.3% from 2023.

Cost Management: Despite inflationary pressures, Greggs has managed to improve its gross margin to 61.8% in 2024 from 60.8% in 2023. However, distribution and selling costs have increased slightly as a percentage of sales.

2. Growth:

The big question is: can Greggs sustain its growth? In such a tough market, with the rising cost of living, it’s a challenge. However, one thing businesses strive to build – and protect – is their brand. Greggs, as a quintessentially British brand, has clearly made an impression. A recent study by value consultancy Brand Finance ranked Greggs among the Top 10 Strongest British Brands of 2024, alongside Costa and KitKat.

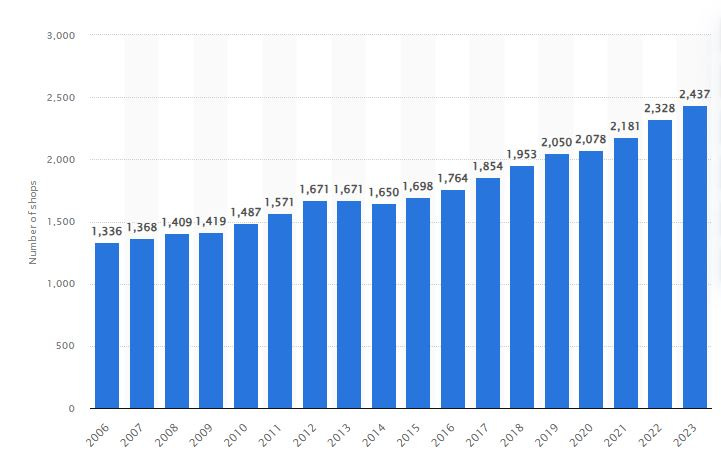

Greggs’ growing popularity is evident – the company has just opened its 2,500th shop! The business is strategically smart, focusing on high-footfall locations. For example, its milestone 2,500th shop opened at a Sainsbury’s petrol forecourt. What’s more, Greggs shows no signs of slowing down, with plans to expand to “more than 3,000 shops in the UK.”

In 2024 alone, 144 of its 226 new openings were away from the high street, including 11 standalone drive-thrus and 11 in large supermarkets. Greggs also increased its presence in transport hubs, with notable openings at Glasgow Central and Motherwell railway stations, London Embankment Underground station, and a second shop at London Bridge station.

^Number of Greggs Shops in the UK 2006 to 2023

Menu growth and innovation are positive signs, and Greggs seems on a mission to cater to a wider range of customers. Its efforts to tap into the health-conscious market are a smart move. Although not entirely healthy, the company has expanded its Healthier Choices menu with new pasta dishes and Chicken Pesto and Spicy Mexican Bean Flatbreads.

Greggs also rotates its product range throughout the year, which helps keep the offering fresh and boosts sales

One challenge bakeries often face is boosting evening sales – and Greggs is going all out to tackle it. Evening sales currently account for 9% of the company’s total sales. Although still a relatively small share, this marks an 8.5% increase since 2023.

Greggs is also capitalising on the growing popularity of meal deals, with plans to expand its offering to over 200 locations in 2025. By introducing more evening-friendly options, such as made-to-order food, the company is successfully attracting more customers during later hours.

3. Market & Competitive Landscape

Greggs operates in a particularly interesting market – the Food-on-the-Go retail sector, within the consumer cyclical industry. What gives Greggs a unique advantage over its competitors is its ability to straddle multiple categories. On one side, it competes with fast-food giants like McDonald’s, while on the other, it takes on coffeehouse chains like Pret A Manger.

Effectively, Greggs is fighting a three-way battle: against bakery chains, fast-food chains, and coffeehouse chains – making its positioning in the market both challenging and opportunistic.

Take a look at the prices below compared to their direct competitors.

Greggs has cemented its position as the UK’s leading food-on-the-go retailer, holding a 19.6% market share in the food-to-go breakfast segment. Its strengths lie in strong brand recognition, affordable pricing, and an extensive network of over 2,600 shops nationwide.

The company’s unique selling points include freshly prepared food, competitive prices, and iconic products like its famous sausage roll. However, Greggs does face some challenges, such as a limited international presence and reliance on physical stores, which could hinder future growth opportunities.

4. Strategic Initiatives & Expansion

Store Expansion

Greggs is aggressively expanding its store network, with plans to open 140 to 150 new stores in 2025, following a record-breaking 226 openings in 2024. The company aims to exceed 3,000 UK stores in the long term, up from its current 2,618 locations.

Evening Trade

Evening sales accounted for 9% of sales in 2024, up from 8.5% the previous year. Greggs is extending trading hours and introducing new menu items to compete more effectively in the evening food-on-the-go market.

Menu Innovation

Greggs continues to innovate its menu to broaden customer appeal, including:

Healthier Choices range with items like the Mexican Bean & Spicy Cheese Flatbread.

New hot options like the BBQ Crispy Chicken Burger and BBQ Chicken Wrap.

Evening-focused products, such as the BBQ Chicken & Bacon Pizza and a four-slice sharing box.

Supply Chain Investments

Greggs is investing in its supply chain to support growth:

A new production line in Newcastle and expanded logistics in Birmingham and Amesbury.

A frozen manufacturing and logistics facility in Derby, opening in 2026, and a new national distribution centre in Kettering, planned for 2027.

4. Risks & Challenges

Greggs faces significant risks and challenges in 2025, primarily driven by economic and inflationary pressures. The company expects overall input cost inflation to be around 6% for the year, with employment costs being the biggest driver. This includes the impact of the National Living Wage increase to £12.21 per hour from April 1, 2025, a 6.7% rise. Supply chain issues remain a concern, with potential disruptions from third-party suppliers and geopolitical factors.

Greggs is investing in its supply chain infrastructure, including new distribution centers and manufacturing facilities, to mitigate these risks. Consumer trends are shifting, with many customers still worried about the cost of living, energy prices, and increased mortgage and rent costs. To address this, Greggs is focusing on offering value-for-money products and expanding its healthier choices range.

Cost of a sausage roll at Greggs in the United Kingdom from 2016 to 2025:

5. Investor Sentiment & Outlook

One of the most important aspects – and why I’ve saved it for last – is taking a deeper dive into the company’s financials.“ Knowing how to read financial accounts is crucial. I remember hearing a fund manager say you’d be surprised at how many fund managers don’t read them—quite concerning”!

I’m always surprised when investors tell me they don’t do this. So, for Greggs, let’s take a quick dive into the numbers and run the analysis:

5.a Capital Expenditure (CapEx)

Calculation:

Capital Expenditure (CapEx) = PP&E (current period) - PP&E (prior period) + Depreciation (current period)

Given:

PP&E (2024) = £664.7m

PP&E (2023) = £510.3m

Depreciation (2024) = £135.8m

CapEx = £664.7m - £510.3m + £135.8m

CapEx = £290.2m

A CapEx of £290.2m indicates a significant commitment to growth and operational enhancement. This investment is strategically allocated across key areas:

Production Capacity Expansion: Adding a fourth production line at Balliol Park, increasing savoury manufacturing capacity by approximately 35%. This investment directly supports volume growth and enables Greggs to meet increasing demand.

Store Network Growth: Net addition of 145 stores (226 new openings, 28 closures, and 53 relocations), expanding the estate to 2,618 shops. This expansion broadens Greggs' market reach and enhances revenue potential.

Supply Chain Enhancements: Expanding distribution centers in Birmingham and Amesbury, adding logistics capacity for an additional 300 shops. This ensures efficient supply chain operations to support store growth. Furthermore, investments into two new major facilities currently underway, including a frozen manufacturing and logistics facility in Derby and a National Distribution Centre in Kettering will increase scale, efficiency and resilience in Greggs' supply chain.

Digital Infrastructure: Continued investment in technology to support the Greggs App and delivery services, with these channels representing 20.1% and 6.7% of company-managed shop sales, respectively. This investment enhances customer experience and drives incremental revenue through digital channels.

Store Refurbishments: Renovation of 165 existing shops, maintaining brand standards and improving customer experience. These upgrades are likely to increase customer footfall and sales.

The high CapEx signals Greggs' proactive approach to growth, with investments aimed at boosting production, expanding its retail footprint, improving supply chain efficiency, and enhancing digital capabilities. While these investments may exert short-term pressure on cash flow and margins, they are expected to drive long-term revenue growth and profitability.

5.b Cash Profit per Share

Calculation:

Pre-tax profit: £203.9m

Depreciation (as per operating expenses): £135.8m

Shares Outstanding: 101.48 million

Approximate Cash Profit = £203.9m + £135.8m = £339.7 million

Approximate Cash Profit per Share = £339.7 million / 101.48 million shares = £3.35 per share or 335 pence per share

Historical Cash Flow Per Share:

2024: 335p

2023: 303.82p

2022: 245.76p

2019: 214.1p

Cash profit per share provides a clearer view of Greggs' operational profitability by adding back the non-cash depreciation expense to pre-tax profit. The cash profit per share has been trending upwards from 2019 through to 2024, indicating increased efficiency in terms of how much of the sales result in cash available to the business.

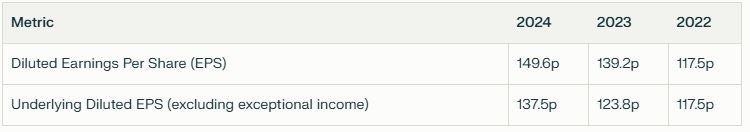

5.c Earnings Per Share (EPS)

EPS Growth: Greggs has demonstrated consistent growth in both diluted and underlying diluted EPS from 2022 to 2024.

Impact of Exceptional Items: There is a noticeable difference between the diluted EPS and underlying diluted EPS figures, particularly in 2023 and 2024, indicating the impact of exceptional items (such as the settlement of business interruption insurance claims and the sale of a legacy supply chain site) on the reported earnings. The underlying EPS gives a clearer picture of the core business performance.

2024 Performance: In 2024, Greggs' diluted EPS increased by 7.5% (from 139.2p to 149.6p), and underlying diluted EPS increased by 11.1% (from 123.8p to 137.5p), indicating a strong underlying business performance.

Consistent EPS growth indicates improved profitability and enhanced shareholder value. The higher underlying EPS growth in 2024 suggests that Greggs' core business operations are becoming more efficient and profitable, which should positively influence investor sentiment.

Beyond CapEx, cash flow, and EPS, we should monitor Greggs' financial health. Note the strong 2024 cash position of £125.3 million, but carefully examine debt, including the revolving credit facility and pension liabilities. Also, analyse operating expenses; 2024 administrative costs were £676.8m (2023: £606.6m).

Overall Summary:

I like how The Dutch Investors view the business “Because Greggs has a ROCE of 20%, a strong moat, reliable management and proven business model, we expect these investments to pay of well”.

Overall, Greggs presents a compelling investment opportunity, demonstrating robust sales growth (+11.3% in 2024), strategic store expansion (net 145 new shops), and attractive shareholder returns with an 11.3% increase in the total ordinary dividend per share. While short-term headwinds from inflationary pressures and significant capital investments (focused on supply chain and technology) are acknowledged, the strength of the Greggs brand and efficient operations, and proven adaptability position it well for long-term growth.

As with any investment, timing is key; however, the current valuation and growth prospects warrant consideration for inclusion in the fund. A patient approach, consistent with a long-term investment horizon, is recommended to capitalize on the anticipated future value creation.

“Buying when valuations are low compared to history increases your chances of making money”.

Here is a link to the Greggs Results: https://a.storyblok.com/f/162306/x/fa0ccf33b0/preliminary-results-for-the-52-weeks-ended-28-december-2024.pdf

Further Reading:

https://www.statista.com/statistics/631011/greggs-number-of-outlets-united-kingdom-uk/

https://a.storyblok.com/f/162306/x/85fc95ce69/preliminary-results-presentation-2024.pdf

https://www.edisongroup.com/research/performing-well-in-a-challenging-market/BM-1328/

The information provided in this article is for informational purposes only and represents my personal opinions and analysis. It should not be construed as financial advice or a recommendation to buy or sell any securities. Investing in the stock market carries risks, and past performance is not necessarily indicative of future results. Readers are strongly encouraged to carry out their own research and seek advice from a qualified financial advisor before making any investment decisions. I do not accept any responsibility for any financial losses or consequences that may arise from reliance on the information presented in this article.

How do you think about growth beyond the UK? Seems like Greggs is already close to their 3,000 store target, so long-term growth will have to come from elsewhere

Greggs is one of our favorites! We also covered the company pretty extensively. The only issue in investors’ minds is the slowing organic growth over the past few quarters and the uncertain UK macro environment.

Nonetheless, over the long term it should be fine.