easyJet (LON:EZJ) Showcasing Their Growth Stats

easyJet Demonstrates Impressive Year-on-Year Growth

Dear Readers,

This week, let's take a closer look at a stock that has been making headlines after their most recent results, rising 5% following the announcement. This article will review the numbers of their most recent results.

EasyJet LON: EZJ

Founded in 1995, easyJet is a British low-cost airline headquartered at London Luton Airport. It operates on over 1,000 routes across more than 30 countries, serving major destinations throughout Europe and select international locations. As one of the largest low-cost carriers in Europe, easyJet is known for its competitive pricing, extensive route network, and a focus on efficiency.

Financial Performance

Q3 headline profit before tax: £236 million, +£33 million YoY

Passenger growth: +8% YoY

Revenue per seat (RPS): +1% YoY, in line with guidance

easyJet holidays profit before tax (PBT): £73 million (Q3'23: £49 million)

Headline cost per seat (CPS) ex fuel: +1% YoY, Fuel CPS reduced by 1%

Headline cost per available seat kilometer (CASK) ex fuel: Flat YoY, total CASK reduced by 1%

Positive Outlook for FY24

Expected FY24 capacity: Approximately 100 million seats

Q4'24 RPS: Expected to continue the trend of Q3'24

easyJet holidays PBT: Expected to exceed £180 million (48% profit growth YoY)

H2 headline CPS ex fuel: Expected to rise by low single digits YoY

H2 fuel CPS: Expected to be flat YoY

Summary

easyJet's third-quarter profit improved by £33 million year-on-year as demand for easyJet's primary airport network continues to grow. Airline passenger numbers increased by 8%, and RPS increased by 1% year-on-year. easyJet holidays grew its PBT by 49% to £73 million with passenger growth of 33%.

As of 30 June 2024, easyJet's net cash position was £456 million (£146 million as of 31 March 2024). All 16 aircraft have been delivered as expected, with the final one received in July.

Bookings for Q4 continue to build, with 69% now sold, +1 ppt YoY with 7% more capacity on sale. easyJet has currently sold 1.5 million more seats for peak summer compared to the same point last year, with total yield broadly flat YoY.

Looking to Q1'25, on-sale capacity is up approximately 5% with 20% of the program currently sold, +2 ppts YoY.

*EasyJet Share price 5y

To note the share price over 5ys is -48% and -1.16% over the year.

CEO Statement

Johan Lundgren, CEO of easyJet, said:

"Our performance in the quarter has been driven by more customers choosing easyJet for our network of destinations and value for money. This result was achieved despite Easter falling into March this year, demonstrating the continued importance of travel. This means we remain on track to deliver another strong summer, taking us closer to our medium-term targets."

Revenue, Cost, and Liquidity

Revenue: Increased by 11% to £2,631 million due to a rise in passenger numbers, growth in ancillary revenue per seat, and the continued growth of easyJet holidays.

Airline headline CPS ex fuel: Increased by 1% as disruption costs improved by 33% YoY, offset by a 1% increase in average sector length due to a higher proportion of longer leisure routes.

Financing costs: Benefitted from decreased gross debt and higher interest rates on floating-rate cash deposits. Foreign exchange movements resulted in a non-operational, non-cash FX gain of £2 million.

Airline numbers YoY:

Capacity

Q3 seats flown: 28.1 million (7% increase YoY)

Load factor: 90% (Q3 FY23: 90%), increasing to 92% in June

Passenger numbers: 25.3 million (Q3 FY23: 23.5 million)

Fuel & FX Hedging

Jet Fuel:

H1'25: 65% hedged at an average rate of $830/MT

H2'25: 31% hedged at an average rate of $813/MT

USD/GBP exchange rate:

H1'25: 65% hedged at 1.26

H2'25: 34% hedged at 1.27

Current spot rate: 1.29 (as of 23.07.24)

Flight numbers:

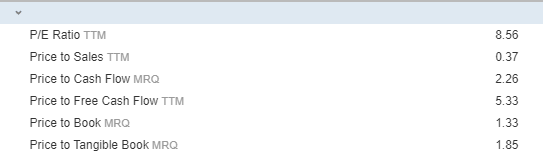

Key Financial Ratios:

Conclusion

easyJet has shown impressive growth and resilience in its latest quarterly results, with a 16% year-on-year profit improvement and a notable rise in passenger numbers and revenue per seat. The airline's continued expansion in easyJet Holidays and a strong net cash position underscore its solid financial health. Additionally, easyJet's positive outlook for FY24, with increased capacity and expected profit growth, indicates a promising trajectory.

Positives:

Strong Financial Performance: Significant year-on-year profit improvement and revenue growth.

Passenger Growth: An 8% increase in passenger numbers highlights strong demand.

Positive Outlook: Promising projections for FY24, including increased capacity and profit growth.

Solid Cash Position: A robust net cash position, indicating financial stability.

Successful easyJet Holidays Expansion: Substantial profit growth in the holiday division.

Negatives:

Cost Pressures: A slight increase in headline cost per seat ex fuel and anticipated cost rises in H2.

Fuel Price Volatility: Although fuel costs decreased, fluctuations in fuel prices remain a potential risk.

Operational Challenges: The challenging European air traffic control environment could impact future performance.

Competitive Market: The competitive landscape in the low-cost airline sector poses ongoing challenges.

Let me know what you think of EasyJet and would you consider buying?

Ollz