Does MONY Group's latest results offer a surprisingly strong performance?

A look further into Mony group:

MONY Group PLC (LON: MONY)

A leading UK-based comparison platform, operates brands such as MoneySuperMarket, TravelSuperMarket, and MoneySavingExpert. The company plays a crucial role in helping UK households save on financial products, insurance, and travel services. In its interim results for the first half of 2024, MONY Group delivered a blend of revenue growth and strategic advancements, but there are also several areas that investors should watch closely as the business faces challenges in key segments.

Lets take a look at their most recent results:

MONY Group’s results for the six months ending 30 June 2024 indicate steady growth in revenue and profitability:

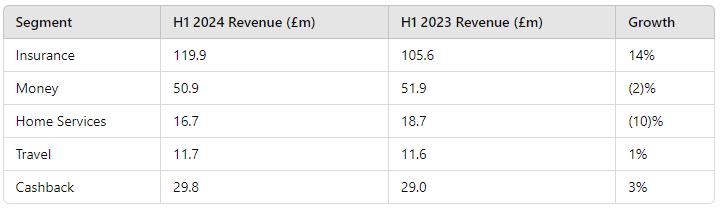

The 5% increase in revenue was driven primarily by insurance and cashback, with insurance seeing a significant 14% growth due to high premium prices in car and home insurance. However, other segments showed weaker performance, including Money (down 2%) and Home Services (down 10%).

Valuation: P/E Ratio and What It Means for Investors

With MONY Group’s share price currently at £2.09, we can calculate the P/E ratio to gauge how the market is valuing the company relative to its earnings. The annualized EPS (based on the H1 2024 EPS of 8.3p) comes out to 16.6p for the full year. The P/E ratio is calculated as follows:

A P/E ratio of 12.6 suggests that MONY is being valued conservatively, particularly when compared to companies with higher growth expectations. This moderate P/E reflects stable earnings but also signals limited immediate upside potential, especially if some segments continue to face headwinds.

Strategic Developments: Positive Steps, But Execution Is Key

MONY Group made strategic progress in several areas during H1 2024, particularly in building out its SuperSaveClub (SSC), a membership-based program designed to drive customer loyalty and engagement. The SSC surpassed 500,000 members by June, with members exhibiting higher engagement and cross-product purchases. Early results suggest that the SSC could help reduce MONY’s reliance on paid advertising, which is a positive long-term move.

Similarly, the MoneySavingExpert App, which has reached 1.4 million downloads, continues to grow in popularity, particularly due to the introduction of features like the Credit Club, which offers a competitive edge by providing users with affordability scores.

However, while these digital initiatives are promising, the success of these programs hinges on their ability to sustain user growth and engagement over the long term. Investors should monitor whether these early indicators translate into sustained revenue growth.

Segment Performance: Strength in Insurance, Weakness Elsewhere

The performance across MONY’s various sectors presents a mixed picture:

While Insurance continues to perform strongly due to high premiums in the car and home insurance markets, other sectors have seen slower growth or declines. Money, for example, fell by 2% due to weaker demand for loans and fewer attractive banking offers in the current high-interest-rate environment. Meanwhile, Home Services struggled with a 10% decline, driven by lower demand for broadband and mobile switching.

This uneven performance reflects the challenges MONY faces in segments sensitive to external factors such as interest rates, competition, and consumer demand. Investors should keep an eye on these underperforming areas, especially if broader economic conditions continue to weigh on consumer spending.

Dividend and Cashflow: Signs of Stability

One positive takeaway from MONY’s results is its improved cashflow position, with operating cashflows up 26% to £51.8 million. This has helped reduce net debt by 54%, providing the company with greater financial flexibility.

MONY Group also announced a 3% increase in its interim dividend to 3.3p per share, underscoring its commitment to returning value to shareholders. Given the strong cashflow generation, this dividend increase looks sustainable in the near term.

Risks and Considerations for Investors

While MONY Group’s financials appear stable, there are a few risks investors should consider. First, the decline in Home Services and Money could persist if high interest rates and competitive pressures continue. The energy switching market also remains largely inactive due to regulatory uncertainties, which could impact future revenue growth in Home Services.

Second, MONY’s reliance on its newer membership-based offerings like the SuperSaveClub introduces an element of uncertainty. While the early signs are positive, there is no guarantee that these programs will deliver the sustained engagement and revenue uplift needed to offset challenges in other segments.

Conclusion:

MONY Group’s H1 2024 results present a mixed picture for UK investors. On the positive side, the company has delivered growth in revenue, earnings, and cashflow, particularly in its insurance and cashback segments. Strategic initiatives like the SuperSaveClub and MoneySavingExpert App offer potential for future growth, but their success is not yet assured.

However, the declines in key areas such as Money and Home Services highlight the challenges MONY faces in maintaining broad-based growth. Investors should remain cautious, particularly with segments under pressure from external factors like interest rates and competition.

Overall, MONY Group offers a stable investment with a healthy dividend and moderate valuation, but there are clear risks that could affect future performance. Investors may want to keep a close eye on the underperforming segments and the company’s ability to execute its strategic goals in the coming months.

Thanks for reading,

Ollz