Dear reader,

What a week it has been! In a market where people are selling there are others who are buying.

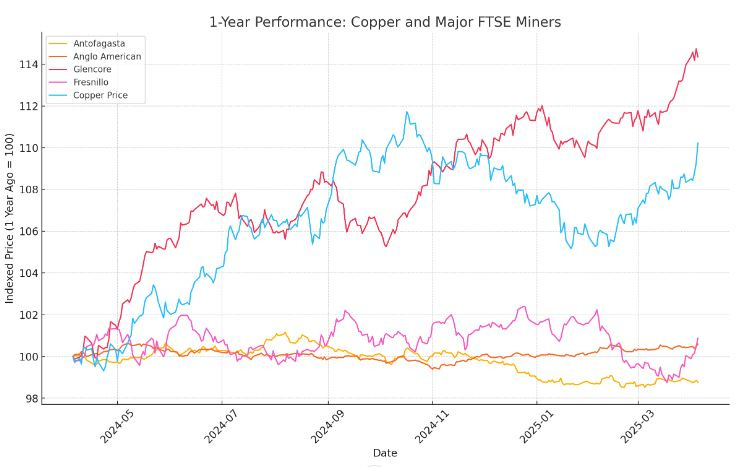

Heavy losses across the board on Friday, 4 April 2025, with mining and energy stocks hit particularly hard. Some of the biggest fallers included:

Antofagasta (-9.35%)

A pure-play copper miner, with around 90% of revenue from copper. Its operations in Chile make it highly sensitive to copper prices and Chinese demand.Anglo American (-8.56%)

More diversified, but still reliant on copper as a growth driver. Its massive Quellaveco project in Peru adds to its copper weighting.Glencore (-9.16%)

A global commodity trader and miner, with big positions in copper and cobalt. Its trading arm is vulnerable to any disruption in global commodity flows.Fresnillo (-10.65%)

Primarily focused on silver and gold. While not a base metal miner, Fresnillo was swept up in the risk-off move across the sector — particularly given its exposure to Mexico.

For mining giants like Antofagasta and Anglo American, which are heavily exposed to copper, the reaction was swift. Copper prices tumbled on concerns that a slowdown in Chinese demand could follow, as tariffs would likely hit China’s export-led economy and infrastructure investment — both major drivers of copper consumption.

Glencore also took a hit, as its copper and broader commodity trading operations are highly sensitive to global trade flows.

Even Fresnillo, though more focused on silver and gold, wasn't immune — investor sentiment turned risk-averse across the sector, especially in emerging markets like Mexico and Chile, where many of these mines are located.

With share prices down sharply, investors will naturally ask: Is this a buying opportunity?

Glencore insiders appear to see value at these levels:

Steven Kalmin, Chief Financial Officer, acquired 588,498 shares at £2.33 on 4 April 2025

Martin Gilbert, Non-Executive Director, purchased 5,000 shares at £2.32 on the same day

These are not expensive stocks — and some are trading at multi-year lows in terms of EV/EBITDA and P/E multiples. However, cheap can get cheaper if earnings expectations fall further. The risk here is that tariffs slow global growth, dampen demand, and compress margins — especially in higher-cost operations.

Still, for income-seeking portfolios, companies like Glencore and Anglo American offer compelling yield support. That could act as a floor in more income-focused UK mandates, especially if we see stability in commodity prices.

It’s easy to forget amidst the sell-off, but the longer-term fundamentals for copper remain compelling:

Electric vehicles use 2.5x more copper than petrol cars.

Grid upgrades and renewable energy infrastructure are highly copper-intensive.

Global supply is constrained. No major new copper discoveries have been brought online at scale in years. Permitting remains slow. ESG standards are rising.

In other words: demand is sticky, but supply isn’t scalable. This is precisely why copper is often called the "metal of electrification" — and why names like Antofagasta and Anglo American still command serious investor attention, even after a sell-off.

What happened on Friday was sharp, but not irrational. Investors are responding to risk — both political and macroeconomic. But volatility often brings opportunity, especially when it forces high-quality names to trade at distressed multiples.

In the coming weeks, markets will be watching:

Any U.S.–China dialogue or shift in rhetoric from Trump’s campaign

Chinese economic data (especially infrastructure and property investment)

Copper inventories and spot prices

Institutional fund moves — are long-only managers stepping back in?

Have a Great rest of the weekend!

Ollz

Top post