Dear Reader

As I start writing this article, it’s the second trading day on the London Stock Exchange (LSE) and what a day it has been! Most days I like to look at the largest riser and fallers of the day and then see the reasons for both.

As of Close of Business (COB) 03/01/2024, I look up my portfolio and see that Anglo American are still down. Initially I took a small position in them and I am now trying to decide if I want to increase this position or not.

So currently the price at £18.66 looks cheap compared to where it was just 1 year ago at £31.80. So that is a -41.31 % fall in the share price (SP).

So reader, this is where we do some digging and ask some basic questions. I will keep this one fairly short with some key points investors should spend some time looking at.

Comparing ANGLO to its Peers:

Examining Anglo American's performance relative to industry peers reveals a notable underperformance, prompting the question of whether improvement is on the horizon.

Anglo American has articulated plans to slash costs by a substantial $1 billion. This strategic move aims to mitigate debt levels and fortify assets through measures like reducing capital expenditure, trimming employee headcount, and implementing other targeted initiatives.

With a robust profit after tax of $9.48 billion in the previous year, a successful implementation of cost-cutting measures could yield a significant boost to the company's bottom line. This, in turn, has the potential to propel an increase in the company's share price.

The current price-to-earnings ratio stands at 5.63, falling below my established benchmark of 10, signaling what I perceive as fair value.

In essence, the future trajectory of Anglo American hinges on the effective execution of its cost-cutting strategies, with the potential positive impact on the bottom line serving as a catalyst for an upward shift in the share price.

Electricity problems and more?

The majority of the group's revenue is intricately linked to South Africa, presenting a unique set of challenges. The prevalent electricity issues have significantly disrupted production, particularly impacting the mining operations.

The persistent challenges with electricity supply have led to a series of setbacks for the mines. Eskom, the national power utility, has resorted to implementing rolling blackouts due to frequent breakdowns at its coal power stations. These blackouts disrupt the regular functioning of mining operations, hampering productivity and exacerbating the already complex operational landscape.

The mining sector relies heavily on a stable and consistent power supply to sustain operations. The disruptions caused by Eskom's rolling blackouts lead to interruptions in critical processes such as extraction, processing, and transportation of minerals. Consequently, this not only results in immediate operational delays but also has cascading effects on the overall production timelines and efficiency of the mining activities.

The intricate connection between the group's revenue and South Africa, coupled with the challenges posed by the electricity crisis, underscores the vulnerability of the mining operations to external factors. Navigating through these challenges demands strategic resilience and proactive measures to mitigate the impact of the electricity-related disruptions on the group's overall performance.

Potential takeover target?

Jefferies analysts suggest that Anglo American could be a takeover target in the industry consolidation trend, with Glencore being named as a potential suitor. This reflects the broader movement in mining, where companies seek mergers for increased efficiency. The mention of Glencore hints at possible shared goals, adding to the industry's evolving dynamics.

Comparative analysis of Anglo American's recent financial quarter

1. Cash Position:

The company's cash has experienced a noteworthy decline, signaling reduced liquidity. Despite this, it's crucial to note that the absolute figures remain substantial, mitigating immediate concerns.

2. Total Assets:

A key metric for business growth is the expansion of total assets, particularly long-term assets. However, a closer look at Anglo American's recent performance reveals only marginal growth in total assets compared to the previous quarter. This indicates a potential area for scrutiny, as robust business growth typically corresponds with a more substantial increase in total assets.

3. Debt Dynamics:

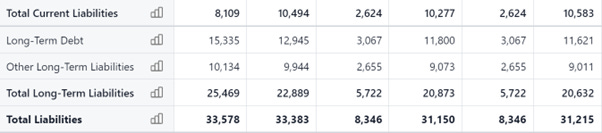

Assessing liabilities is integral, as it offers insights into how a company leverages debt. While debt can be a strategic tool, investors prefer a judicious use of it. Anglo American's total liabilities have increased from $31,150 million in the previous quarter to $33,578 million in June 2023. This uptick raises concerns, as it signifies a higher debt burden that investors might find less favourable.

Commodities:

Anglo American deals in a variety of commodities, notably platinum group metals (PGMs) like platinum, palladium, and rhodium. The company is also involved in the extraction of other valuable resources such as copper, iron ore, and diamonds through its partnership with De Beers.

Platinum prices back to 1985. The price shown is in U.S. Dollars per troy ounce. The current price of platinum as of January 05, 2024 is $962.66 per ounce.

Operating across diverse regions, including South Africa, Chile, Australia, and North America, Anglo American foresees a 3% decline in production for 2025. However, there's optimism as the company projects a subsequent 4% increase in production by 2026. This growth is attributed to anticipated higher volumes in key commodities like copper, iron ore, steelmaking coal, and diamonds.

In a strategic move, Anglo American aims to significantly reduce its capital expenditures by $1.8 billion from 2023 to 2026. This reduction plan involves cutting capital expenditure on projects by $0.8 billion in 2024, bringing it to $5.7 billion. There's a further reduction of $0.4 billion in 2025, maintaining this reduced level at $5.3 billion in 2026. Additionally, unapproved projects are temporarily halted as part of this financial adjustment.

Investors can anticipate valuable insights into the company's performance with the upcoming fourth-quarter production update scheduled for February 8. This update is expected to provide a comprehensive overview of operational achievements and future prospects.

Insiders dealing:

The table shows the latest director deals. I always like to look into director deals as this can show what the insiders are buying and how much. Its always good to see the insiders buying as this can indicate that they see the share price as cheap. As we can see dear reader, the most recent insider buys have been in December and show a considerable amount of money spent on shares which are indicating that the current share price can be viewed as cheap.

Moving Average:

Anglo comapred to 50 & 25 day moving average. Showing the 50 day moving falling below the 25 day.

The 25-day and 50-day moving averages help filter daily price noise, providing a stable view of a stock's performance. Their crossovers indicate trend changes – a 25-day crossing above a 50-day suggests an upward trend, while the opposite may signal a downtrend. The 50-day moving average serves as a reference for support or resistance levels. The 25-day moving average strikes a balance between sensitivity to short-term changes and smooth trend identification.

The end:

I will be watching the share price over the next couple days but at these prices its looking attractive.

Remember reader these are some starting points to look into Anglo and do not take this as investment advice. There are many other points you can look into, and I would always encourage you to do your own investment research. I am always intrested in what you think and if you own Anglo, let me know down below.

But today I will leave you with one of my favourite quotes:

"Buy to the sound of cannons, sell to the sound of trumpets." Nathan Mayer Rothschild.

Thanks for reading, 1Trueinvesting