Phoenix Group Holdings (LON:PHNX)

Phoenix Group Holdings, a stalwart of the FTSE 100, is currently drawing attention due to its stock hitting close to one-year lows. This price movement could hint at a potential bargain, but a thorough examination of their latest financial results is essential to determine if the lower stock price is justified or presents a buying opportunity.

Recent Financial Highlights

Here’s a breakdown of the most crucial figures from Phoenix Group's recent financial reports:

Analysis and Market Sentiment

Phoenix Group heralded these results as a display of "strong full-year results," and rightfully so. The company's ability to exceed cash generation targets and drive significant new business growth underscores its robust operational capabilities, particularly in the retirement solutions sector. With the vision to become the UK's leading retirement savings and income business, management's outlook aligns well with the strategic milestones being achieved.

Despite these strong results, Phoenix's share price has been under pressure, dropping 20% over the past five years and recently touching close to one-year lows. This could be reflective of broader market sentiments or possibly specific investor concerns about the sustainability of these returns amid economic fluctuations.

Valuation and Investment Considerations

The price-to-earnings (P/E) ratio remains on the higher side, which might suggest that the stock is still overvalued despite recent declines. However, as the market continues to adjust, there may be an attractive entry point for investors who are bullish on Phoenix's fundamentals and management's forward-looking strategy.

Ill be waiting and watching this share price and decide if I want to make an entry.

M&G (LON:MNG)

Another one on my radar after a recent crash of 15%. Another FTSE 100 company that sold off from Prudential. With recent good news and the company on track to generate £2.5 bn in capital by 2024 I’m impressed by the growth and the growth of the dividend.

Their most recent financial results:

Good results from M&G. 2022 was an awful year all round and that includes M&G. So its interesting to watch how they have come back strong and fighting. With a strong board with high hopes this can seem promising.

Currently with M&G trading at 16 x earnings, it can seem a little overpriced. That’s why I think ill be waiting for the share price to drop a little on these to take a position.

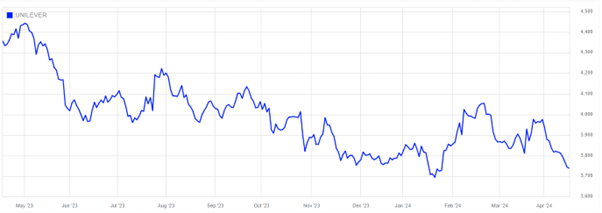

Unilever (LON:ULVR)

With recent news on them selling their ice cream business (Ben & Jerrys!!!!) This is another stock that im watching as it comes falling back down to to 1 year lows.

The Segments:

Unilever operates across five primary segments: Beauty & Wellbeing (21.0% of group turnover), Personal Care (23.0% of group turnover), Home Care (21.0% group turnover), Nutrition (22.0% of group turnover), and Ice-Cream (13.0% of group turnover).

In the fiscal year 2023, all segments except Ice-Cream experienced notable sales growth. However, Ice-Cream sales underperformed due to consumer preferences shifting towards competing brands with better value propositions, compounded by unfavourable summer conditions.

Most recent financial results:

Total sales fell 3.0% YoY to €14.2 billion due to currency fluctuations. Underlying sales grew 4.7% YoY, driven by a 2.8% price increase and 1.8% volume rise. Ice Cream sales remained stable, while Beauty & Wellbeing, Personal Care, Home Care, and Nutrition divisions experienced declines. Geographically, sales were negatively impacted in the Asia Pacific Africa region, offset by growth in The Americas and Europe regions.

This is one stock where the share price is getting very close to one year lows. However again with P/E higher then the rest at 17%, I might wait a little and see what time will do with the share price.

Thanks for reading! Please do let me know what you think of these 3 stocks.

Always remember that this is not investment advice and you should do your own research

Ollz