Dear reader,

As we enter into a Labour government, it's time to examine some opportunities. Labour has pledged to build 1.5 million new homes. Whether right or wrong, I want to examine if there are good opportunities in house builders across the FTSE 100 and FTSE 250.

Here are 3 housebuilders that could do well:

Persimmon

Primarily involved in the construction of residential properties, ranging from affordable housing to luxury homes. It has a strong presence across the UK with multiple regional offices and developments. They build thousands of homes annually, targeting various market segments including first-time buyers, families, and investors.

The chart above shows Persimmon over a 5 yr period. Still trading a lot lower then the last couple years.

Q1 Performance:

Full-Year Completions Target: On track to deliver between 10,000 and 10,500 completions for 2024.

Q1 Home Completions: Achieved 1,027 homes compared to 1,136 in Q1 2023.

Private Sales Rate: Net private sales per outlet increased by 6% to 0.66.

Private Forward Sales: Secured £1.14 billion in private forward sales, up 18% from the previous year.

Average Selling Price: Private average selling price rose by 6% to approximately £283,000.

Land Holdings: Owned and controlled approximately 82,500 plots as of March 31, 2024.

Land Spend: Invested £145 million in land during Q1 2024.

Outlet Expansion: Opened 28 new outlets, totaling 263 outlets by the end of Q1 2024.

Cost Management: First-half performance impacted by £96 million in land creditor settlements, down from £131 million in Q1 2023.

Outlook:

Anticipated growth in completions to 10,000-10,500 for 2024.

Expectation of reversing trends in build cost inflation and selling prices in the second half of the year.

Key Financial Ratios:

Barret Developments

Barratt Developments is a major housebuilding company in the United Kingdom, established in 1958. It operates through various brands, including Barratt Homes, David Wilson Homes, and Barratt London, focusing on the construction and sale of residential properties.

Q1 Highlights

Net Private Reservations: Achieved a 5.5% increase in net private reservations per active outlet per week, reaching 0.58 (FY23: 0.55), including a contribution of 0.08 from the private rental sector and social housing.

Total Home Completions: Completed 14,004 homes in FY24, including 536 from joint ventures, reflecting an 18.6% decrease compared to 17,206 in FY23.

Forward Sales: Recorded total forward sales of £1.91 billion as of June 30, 2024, comprising 7,239 homes, down from £2.22 billion and 8,995 homes in June 30, 2023.

Adjusted Profit Before Tax: Anticipates FY24 adjusted profit before tax slightly exceeding previous expectations.

Legacy Property Charges: Recognized approximately £192 million in charges related to legacy property issues, up from £179.2 million in FY23.

Year-End Net Cash: Maintained a robust balance sheet with net cash of approximately £865 million as of June 30, 2024, compared to £1,069.4 million in June 30, 2023.

Future Home Completions: Forecasts FY25 home completions in the range of 13,000 to 13,500, including approximately 600 from joint ventures.

Sales Outlets: Operated from an average of 346 active sales outlets in FY24, down from 367 in FY23, with 326 active outlets as of June 30, 2024.

Home Completion Decline: Experienced a 28.5% decline in total home completions in the first half of FY24, with a more modest 8.7% decline in the second half.

Merger with Redrow: Shareholders approved the merger with Redrow, pending CMA approval expected by August 8, 2024.

Land Activity: Increased land approvals with a net addition of 12,439 plots in FY24, contrasting with a net reduction of 812 plots in FY23, preparing for significant land spend in FY25.

Outlook

FY25 Expectations: Anticipate home completions in the range of 13,000 to 13,500, including 600 from joint ventures. Confident in growth of average sales outlets into FY26 despite a challenging macroeconomic environment.

Collaboration with Government: Welcoming government initiatives to unlock economic growth and tackle housing undersupply. Commitment to working with stakeholders to address supply side constraints.

Key Financial Ratios:

Taylor Wimpey PLC

Taylor Wimpey is a well-established construction and real estate development company based in the United Kingdom. Known for its extensive portfolio, Taylor Wimpey focuses on both residential and commercial projects. The company prioritizes quality, innovation, and sustainability in its developments, aiming to deliver value to its customers and stakeholders.

Q1 Highlights:

- Revenue decreased by 20.5% to £3,514.5 million, with operating profit down 49.1% to £470.2 million, and profit before tax declining by 42.8% to £473.8 million.

- Basic earnings per share fell by 45.3% to 9.9 pence, while adjusted basic earnings per share decreased by 50% to 9.9 pence.

- Ordinary dividend per share increased by 1.9% to 9.58 pence, and tangible net asset value per share rose by 0.5% to 127.1 pence.

- Net cash reduced by 21.5% to £677.9 million.

- Group completions (including JVs) were 10,848, and the UK net private sales rate for the year was 0.62 homes per outlet per week.

- UK average selling prices on private completions increased by 5.1% to £370k, with the overall average selling price up 3.5% to £324k.

- Delivered annualised cost savings of £19 million by aligning build rates to demand changes and opened 47 new outlets, ending the year with 237 UK outlets.

- Achieved a five-star rating for customer service in the Home Builders Federation (HBF) survey and improved build quality with a Construction Quality Review score of 4.89.

- Reduced absolute operational carbon emissions by 35% from a 2019 baseline and published a Net Zero Transition Plan with targets independently validated by the Science Based Targets initiative.

- Early 2024 trading shows signs of improvement with reduced mortgage rates enhancing affordability and customer confidence; UK completions (excluding JVs) are expected to be between 9.5k and 10k homes, with completions weighted 45%/55% in favor of the second half of the year.

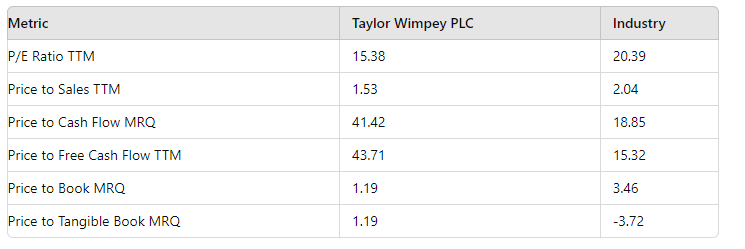

Key Financial Ratios:

Thanks for reading and let me know what you think, will these do well over the coming months?

Ollz